GST Ready ERP Software

GST is one indirect tax for the whole nation which will make one unified common market

What is GST? How does it work?

GST is a single tax on the supply of goods and services right from the manufacturer to the customer. Credits of input taxes paid at each stage will be available to subsequent stage of value addition. The final consumer will bear the GST charged by the last dealer.

What are the benefits of GST?

Easy Compliance

Uniformity of tax rates & structures

Removal of cascading

Improved competitiveness

Gain to Manufacturers & Exporters

Single tax for the value of Goods & Services

Transparent tax for the value of Goods & Services

Relief in overall tax burden

GST Administration

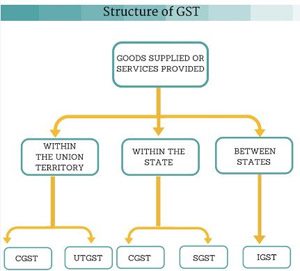

There will be two components of GST - CGST (Central) and SGST (State)

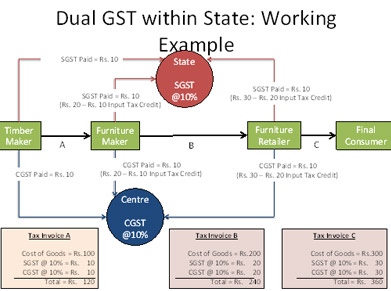

Both central and state will simultaneously levy GST across value chain. Tax will be levied on every supply of goods and services. The input credit tax of CGST would be available for discharging CGST liability & SGST credit will be allowed for paying the SGST on out put. No cross utilization is permitted.

GST tax charged under CGST & SGST

The Central GST and the State GST would be levied simultaneously on every transaction of supply of goods and service except on exempted Goods & Service, goods which are outside the purview of GST and the transactions which are below the prescribed threshold limits. Further, both would be levied on the same price or value.

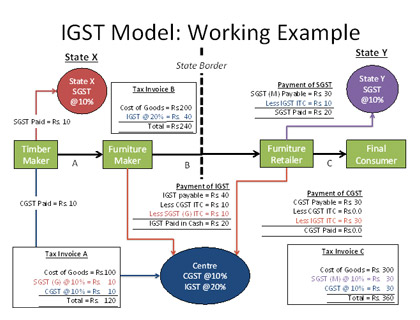

How inter-state transactions of Goods & Services will be taxed under IGST?

Incase of inter-state transactions, the Centre would levy and collect the Integrated Goods and Service Tax (IGST) on all inter state supplies of goods and services. The IGST will roughly be equal to CGST plus SGST. The inter state seller would pay IGST on the sale of his goods to the Central Government after adjusting credit of IGST, CGST and SGST on his purchases.

The Exporting state will transfer to the Centre the credit of SGST used in payment of IGST. The importing dealer will transfer to the Centre the credit of SGST used in payment of IGST. The importing dealer will claim credit of IGST while discharging his output tax liability (both CGST and SGST) in his own state. The Centre will transfer to the importing State the credit IGST used in payment of SGST. Since GST is a destination based tax ,all SGST on the final product will ordinarily accrue to the consuming state.

Will cross utilization of credits between Goods and Services be allowed under GST?

Cross regime of CGST between goods and services will allowed. Similarly, the facility of cross utilization of credit will be available in case of SGST. However, the cross utilization of CGST and SGST would not be allowed except in the case of inter-State supply of goods and services