Transaction management & Book Keeping

All transactions related to purchase, sales, inventory, production, Bank are captured in ERP. They can be edited, deleted whenever needed. Company maintains Profit/Loss Report, Balance Sheet, Cash Flow transactions, Bank transactions and reconciliation, Ledger wise transactions. User can track agewise billing, their payment/receipts, payable, receivables etc. ERP system shows monthwise GST and other opening and closing balances.

The output refers to the information generated by financial reports, used to analyze and present financial data. Some of the types of reports that can be generated by financial reports include:

- Income statement (P&L)

- Balance sheet

- Cash flow statement

- Accounts receivable and accounts payable reports

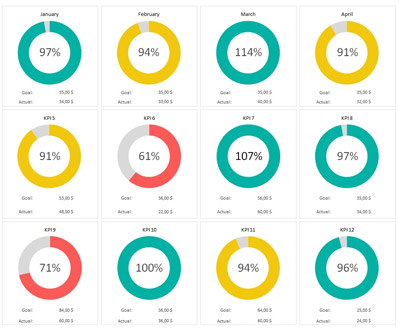

- Budget vs actual analysis

- Key performance indicators (KPIs)

- Profit and loss by product/service

- Trend analysis

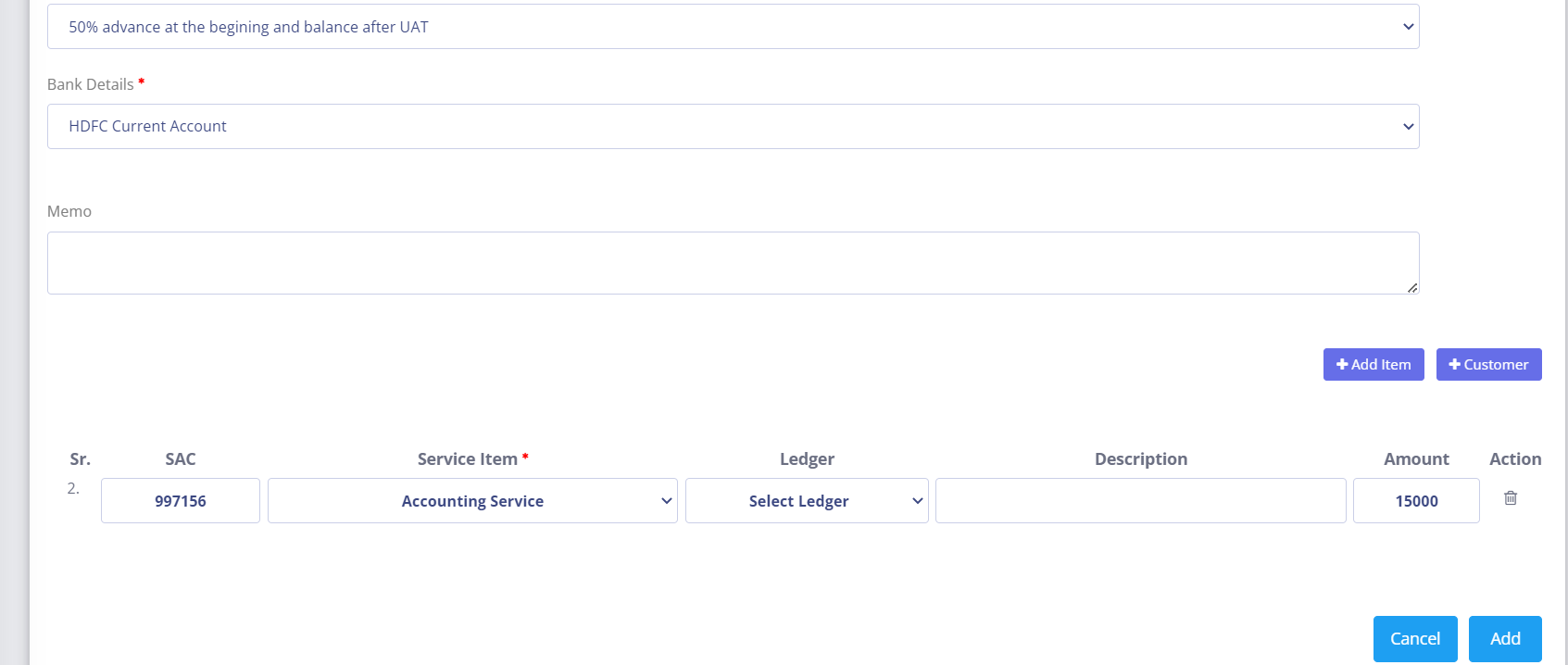

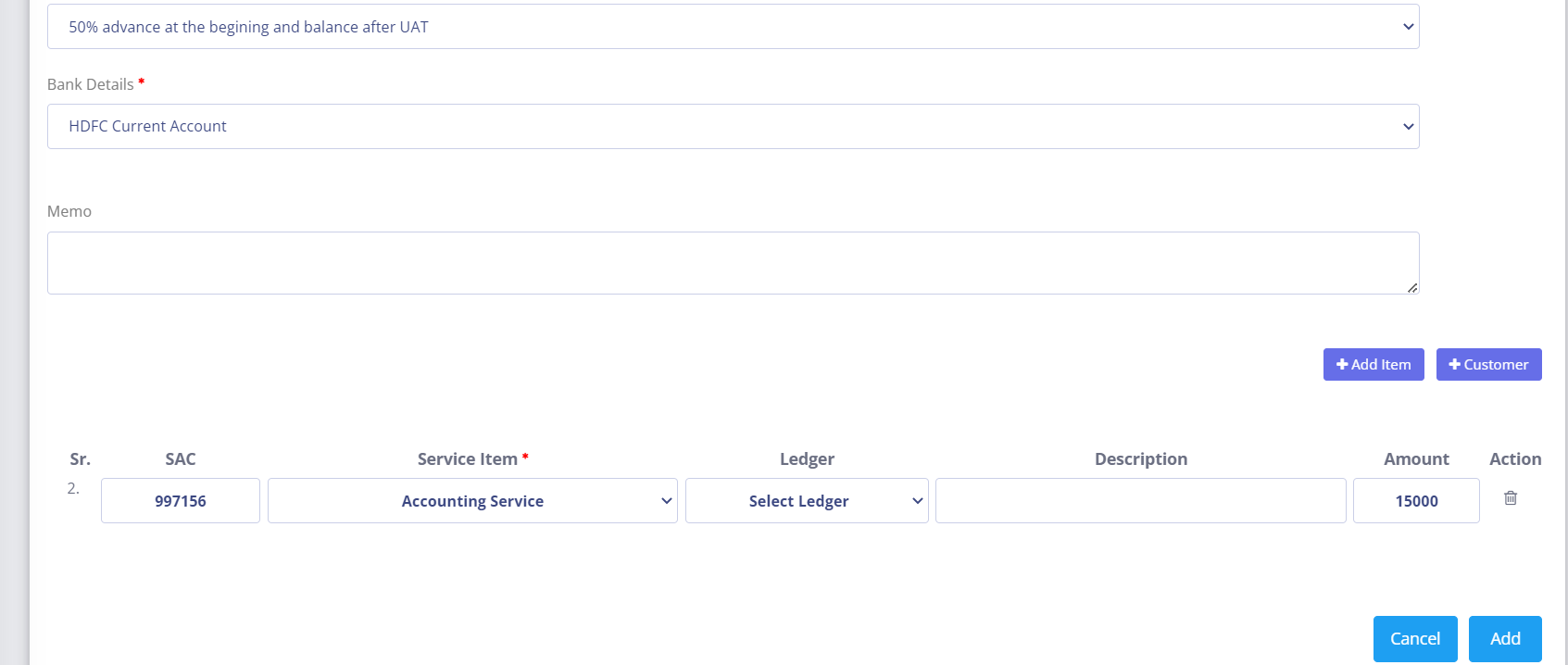

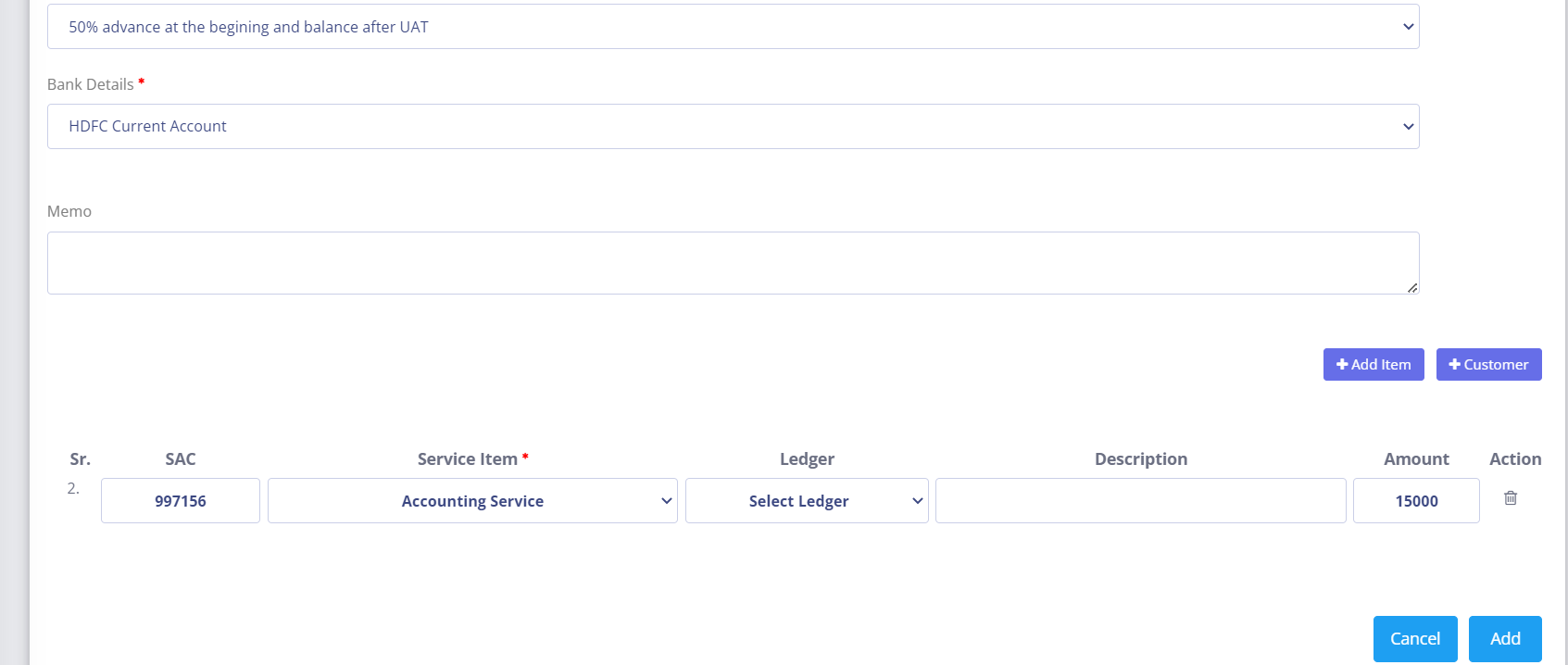

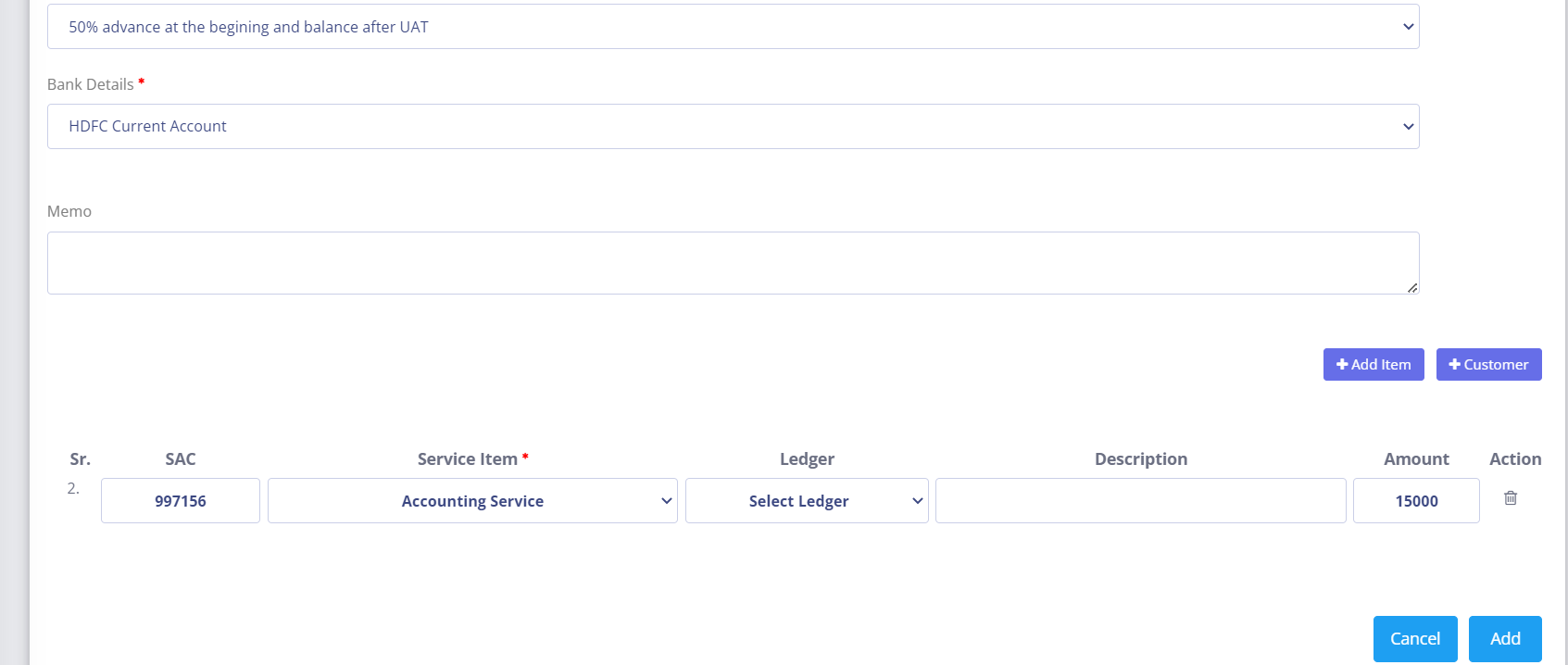

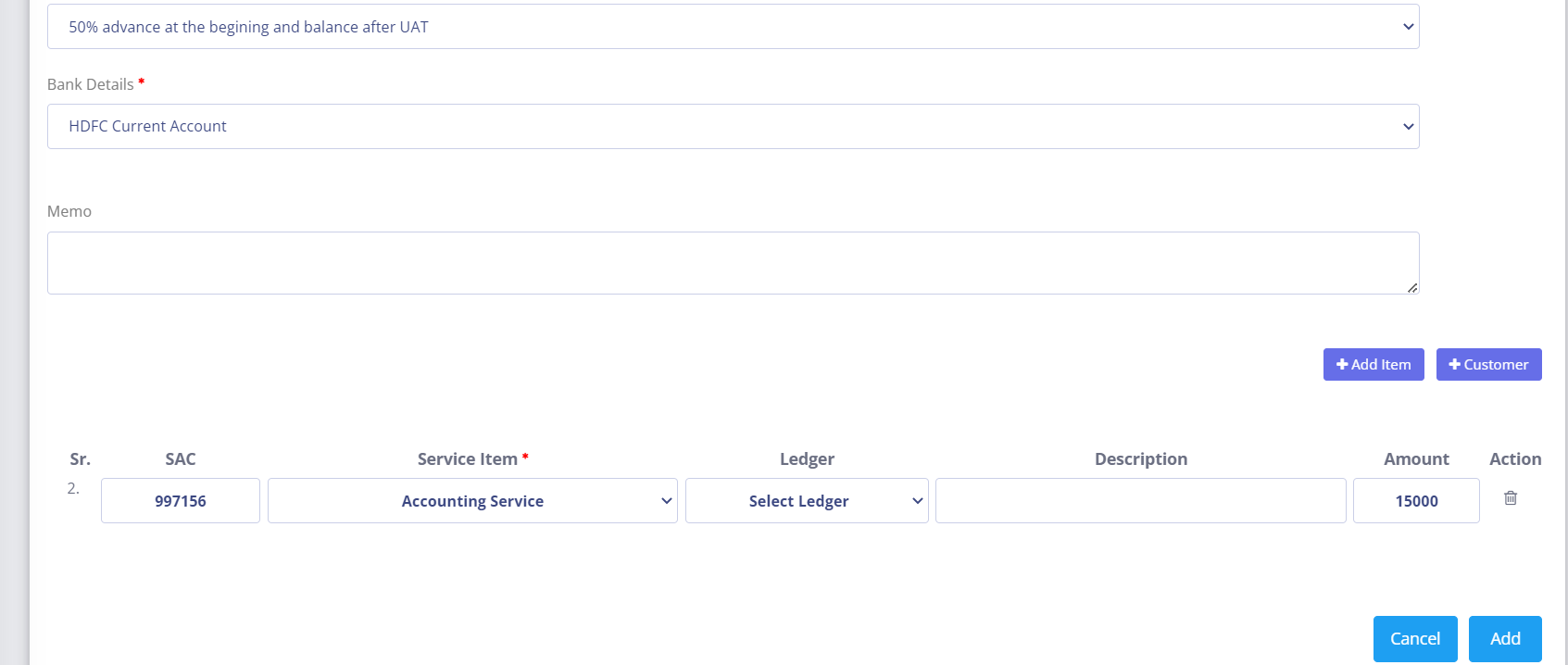

Service Invoice

Service invoice management refers to the process of creating, storing, and tracking service invoices to ensure accurate billing and payment collection. This can include tasks such as:

- Generating invoices for services provided

- Sending invoices to customers

- Recording payments received

- Following up on overdue invoices

- Keeping accurate records of invoices and payments

- Providing reports and financial summaries of invoicing activity

Tax (GST) & TDS

These reports have month wise total GST amount, GST break ups of SGST, CGST and IGST.

TDS payable and receivable as obtained from Purchase/Input Invoice transactions are shown separately.

Transactions like Purchase Invoice, Input Service Invoice and Bank Receipt with TDS option capture the necessary TDS rate applicable. The system interally adds this amount

to TDS Payable or similar TDS ledger which are eventually aggregated to show the amount as per the date in the following reports. User can also track how much is the TDS liability

at any point of time and the TDS amount paid so far.

Peacksoft ERP being completely GST compliant, makes notes of GST amounts in every Purchase and Sales transactions. This GST liability can also be found in Accounts Receivable and Payables

reports.

GSTR Filing

GSTR Filing in Peacksoft ERP is as easy as clicking few buttons of prepare, upload, submit and file.

The process involved in each filing is first to pull out all

necessary data for a given month or quarter from the ERP and show in the format as prescribed by GST council.

User then verifies the data and gets validated by the software.

After this, it allows the user to prepare the JSON format to be downloaded so that they can be used in GST portal for upload or directly uploaded to GST portal

using Upload button in the filing preview.

Next operation is to submit and file the GSTR process and complete the filing process by submitting the OTP sent over the registered mobile no.

- Types of GSTR Filing supported

- GSTR1

- GSTR2

- GSTR3B

- GSTR4

Get Started with Peacksoft ERP Today

Intuitive solutions on cloud with integrated features like Accounting, Purchase, Sales, Production, CRM, Payroll, Inventory & Filing of all compliances. . Call us at +91-86608 58802 (M: 9845167247) to schedule a consultation.

Manage sales through quotation by updating information and proceed to Sales order, Sales delivery , Sales invoice by click of few button.

Manage sales through quotation by updating information and proceed to Sales order, Sales delivery , Sales invoice by click of few button.

Manage Purchases through order by updating information and proceed to GRN, Purchase Invoice by click of few buttons.

Manage Purchases through order by updating information and proceed to GRN, Purchase Invoice by click of few buttons.

Comprehensive Inventory management features for small and mid size companies.

Comprehensive Inventory management features for small and mid size companies.

Manufacturing

Manufacturing