Peacksoft offers complete capabilities for your finance department starting from general ledger to reporting and ledger transactions, Receivables & Payables, Service Invoice management, Agewise Analysis.

Peacksoft Accounting

Accounting & Bookkeeping involves the day-to-day recording of all financial transactions. The work can be basic and administrative, but bookkeeping is at the financial core of a company. Bookkeeping includes the maintenance and balancing of ledgers, handling of accounts receivable and accounts payable and managing payroll. Bookkeeping is considered the first step in the accounting process. Accounting turns a collection of data into useful information that managers can rely on to determine the health of the business. Accounting focuses on the bigger picture and includes generating and analyzing financial statements, preparing and filing tax returns and providing forecasts and financial advice. Accounting software automates many traditional bookkeeping tasks.

Accounting & Bookkeeping tasks

- Recording transactions: Bookkeepers record every financial transaction in the general ledger, a master document that shows credits, debits and balances for each financial account. Bookkeepers often use double-entry accounting, a system that requires two balancing entries — one debit and one credit — for every transaction within a business to ensure accuracy.

- Reconciling bank statements: This task, often handled monthly, involves matching recorded transactions in the bank account ledger and general ledger with bank statements to ensure that accounts are balanced.

- Account Receivable and Payable: Accounts receivable (AR) involves generating invoices, establishing terms of payment and tracking down overdue payments. Accounts payable involves making sure vendors are paid in a timely fashion.

- Managing payroll: Bookkeepers are often charged with reviewing employee time sheets, calculating deductions and processing payroll.

- Preparing adjusting entries: This task entails recording income and expenses that have occurred but aren't yet recorded in the bookkeeping process, such as interest earned but not yet received.

- Conducting audits: Accountants perform routine audits to ensure that financial statements and the books are following ethical and industry standards.

- Preparing and filing tax returns: Accountants are especially helpful during tax season. They handle tax planning, preparation and filing, which helps minimize tax liability and the chances of being audited by the ROC.

- Providing financial advice: Accountants can help business owners understand the impact of financial decisions and assess the health of the company.

Accounting Cycles

Bookkeepers record and organize financial data, and accountants analyze that information to provide business owners with important insights and financial advice. This is all part of the accounting cycle — the process businesses use to record and analyze their financial data. The goal of this process is to produce an accurate account of a company's financial health. Some of these steps are performed by a bookkeeper, some by an accountant and increasingly some are automated by accounting software.

- Identify and categorize transactions.

- DRecord journal entries.

- Post journal entries in the general ledger.

- Prepare an unadjusted trial balance.

- Make adjusting journal entries.

- Prepare an adjusted trial balance.

- Prepare financial statements like P&L, Balance Sheet, Cach Flow.

- Close The books.

Read more on Accounting & Tax Filing

Transaction management

Transaction management refers to the process of overseeing and coordinating the various elements involved in a transaction between parties. In a business context, transaction management can involve managing payments, shipments, invoicing, and other activities related to the sale and delivery of goods or services.

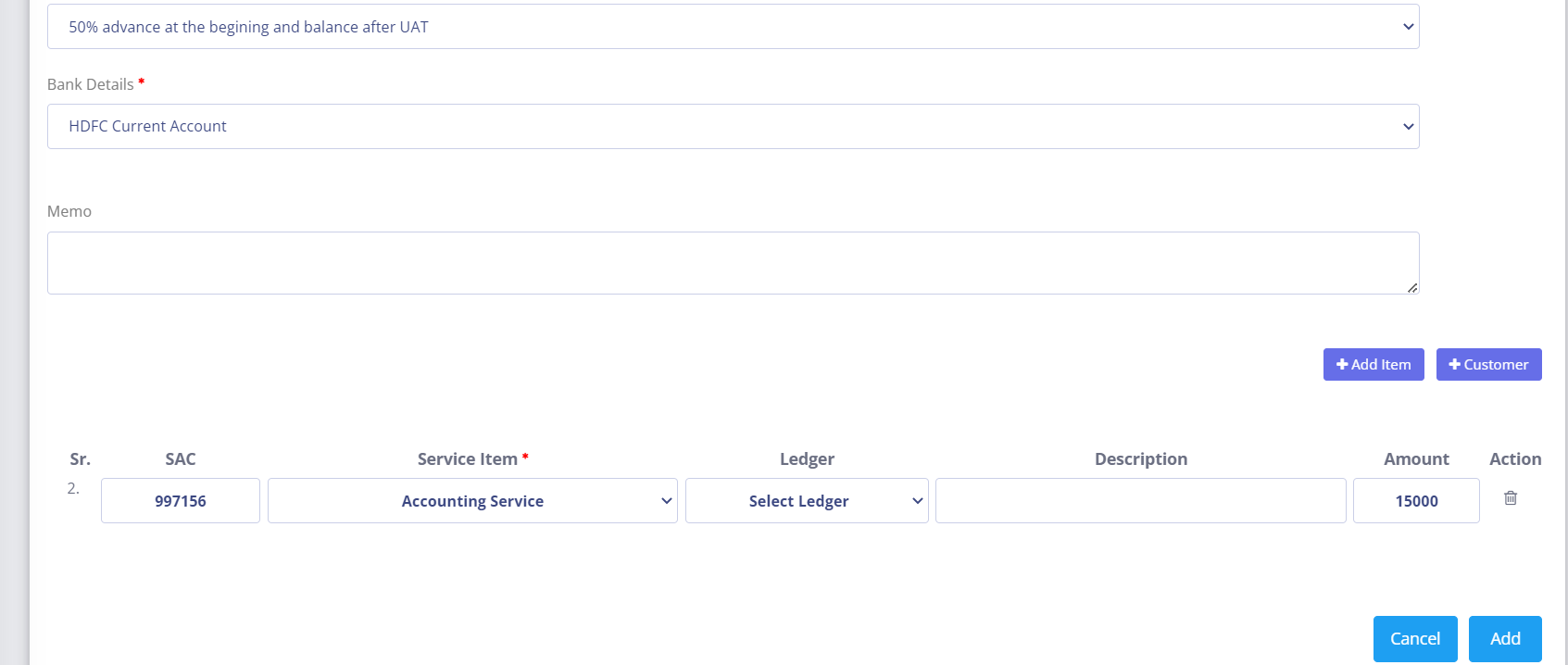

Service Invoice

Service invoice management refers to the process of creating, storing, and tracking service invoices to ensure accurate billing and payment collection. This can include tasks such as:

- Generating invoices for services provided

- Sending invoices to customers

- Recording payments received

- Following up on overdue invoices

- Keeping accurate records of invoices and payments

- Providing reports and financial summaries of invoicing activity

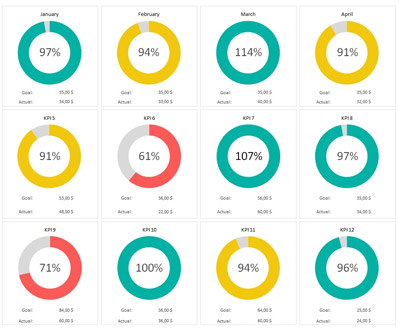

Financial reports

The output refers to the information generated by financial reports, used to analyze and present financial data. Some of the types of reports that can be generated by financial reports include:

- General Transactions for all types of voucher

- Ledger and Group wise transactions

- Bank transaction

- Agewise analysis of receivales and payables

- Income statement (P&L)

- Balance sheet

- Cash flow statement

- Accounts receivable and accounts payable reports

- Budget vs actual analysis

- Key performance indicators (KPIs)

- Profit and loss by product/service

- Trend analysis

Get Started with Peacksoft ERP Today

Intuitive solutions on cloud with integrated features like Accounting, Purchase, Sales, Production, CRM, Payroll, Inventory & Filing of all compliances. . Call us at +91-86608 58802 (M: 9845167247) to schedule a consultation.

Manage sales through quotation by updating information and proceed to Sales order, Sales delivery , Sales invoice by click of few button.

Manage sales through quotation by updating information and proceed to Sales order, Sales delivery , Sales invoice by click of few button.

Manage Purchases through order by updating information and proceed to GRN, Purchase Invoice by click of few buttons.

Manage Purchases through order by updating information and proceed to GRN, Purchase Invoice by click of few buttons.

Comprehensive Inventory management features for small and mid size companies.

Comprehensive Inventory management features for small and mid size companies.

Manufacturing

Manufacturing