E Way Bill Generation

Context

The GST system provides a provision of e-Way Bill, a document to be carried by the person in charge of conveyance, generated electronically from the common portal. This document aims to explain how to generate the e-Way Bills by the Tax payers or Transporters. The best method of EWB generation for such large tax payers, who generate the large number of e-Way Bills, is to build API interface with the E-way bill system. This is site-to-site integration of the systems for e-way Bill generation. In this method, the tax payer system will directly or through GSP request e-way bill to the E-way Bill system while generating invoice and get the e-Way Bill number. This can be printed on the Invoice document and movement of the goods can be started. This avoids duplicate data entry and eliminates data entry mistakes.

E Way Bill in Peacksoft ERP

the sales invoice having the goods value more than Rs 50000 is elligible for E Way Bill generation.

E Way Bill Preview and Generate E Way Bill

This validates Supplier and Buyer mandatory details like address, place, state code and pincode. It also checks the invoice item wise mandatory details. It shows alert messages for any validation errors and does not allow user to generate the E Way Bill. The user needs to provide GSTN server EWay Bill registration credential details to be able to communicate to the EWay Bill Server via GSP Provider (Tera Software, MasterGST API services) API integrated in the Peacksoft ERP.

Generate E Way Bill button will create the number and keeps reference in the Invoice as follows.

E Invoicing in Peacksoft ERP

E-Invoice is a system in which B2B invoices are authenticated electronically by GSTN for further use on the common GST portal. Under the electronic invoicing system, an identification number will be issued against every invoice by the Invoice Registration Portal (IRP) to be managed by the GST Network (GSTN). All invoice information is transferred from E-Invoicing portal to both the GST portal and E-Way bill portal in real-time. Therefore, it eliminates the need for manual data entry while filing GSTR-1 return as well as generation of part-A of the e-way bills, as the information is passed directly by the IRP to GST portal.

E Invoice Preview and Generate E Invoice

This validates Supplier and Buyer mandatory details like address, place, state code and pincode. It also checks the invoice item wise mandatory details. It shows alert messages for any validation errors and does not allow user to generate the E Invoice. The user needs to provide EInvoice server user registration credential details to be able to communicate to the EInvoice IRP Portal via GSP Provider (Tera Software, MasterGST API services) API integrated in the Peacksoft ERP.

Generate E-Invoice button will create the IRN and keeps reference in the Invoice as follows.

E Invoice details can be added in the Tax Invoice as shown below.

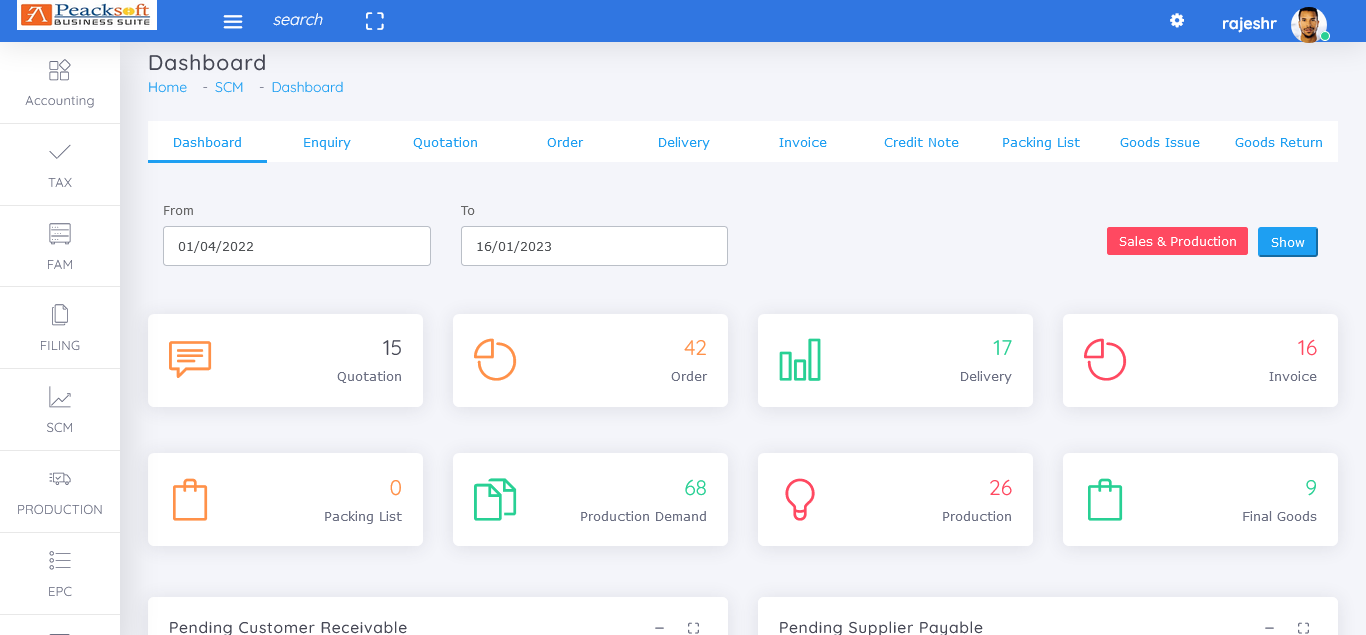

Get Started with Peacksoft ERP Today

Intuitive solutions on cloud with integrated features like Accounting, Purchase, Sales, Production, CRM, Payroll, Inventory & Filing of all compliances. . Call us at +91-86608 58802 (M: 9845167247) to schedule a consultation.