Accounting Tax Filing Invoice Management

Peacksoft ERP Accounting Tax Filing & Invoice Management provides a comprehensive system to streamline tax compliance, invoicing, and financial reporting for businesses. Here's how it operates:

Invoice Management:

1. Sales Invoices:

Automatically generate sales invoices based on customer orders and deliveries.

GST-compliant invoices for both B2B and B2C transactions.

Users can easily generate e-Invoices integrated with the GST Network (GSTN) for real-time validation and submission.

2. Purchase Invoices:

Manage purchase invoices for all goods and services procured.

Capture input tax credits for GST filing.

3. Invoice Status Tracking:

Track invoice status from creation to payment or pending.

Set up reminders for overdue invoices or upcoming payments.

4. E-Invoicing:

Directly integrate with the Invoice Registration Portal (IRP) to generate e-Invoices with IRN numbers.

Data is automatically transferred to the GSTN and e-Way Bill Portal, eliminating duplicate data entry.

Validation of buyer/supplier details ensures compliance and reduces errors.

5. Tax Filing:

GST Filing:

Automatically generate reports for GSTR-1, GSTR-3B, and other necessary GST filings based on the recorded sales and purchase invoices.

The system auto-populates tax data, reducing manual entry and ensuring accuracy.

Validate supplier/buyer details, including GSTIN, address, and invoice details before filing.

6. E-Way Bill Integration:

Generate e-Way Bills for shipments directly from sales invoices.

Validate address, state code, and other shipment details to ensure e-Way Bill compliance.

Track the status of generated e-Way Bills and link them to corresponding delivery challans and tax invoices.

Tax Credit Management:

Manage input tax credits (ITC) on purchase invoices to ensure accurate tax filing.

Automatic reconciliation of tax credits with GST returns for both input and output tax liabilities.

7. Tax Reports:

Generate detailed tax liability and tax credit reports for accounting and filing purposes.

The system offers a monthly tax summary showing total GST collected, GST paid, and ITC utilized for filing purposes.

8. Filing and Payment Compliance:

Tax Payment Reminders:

Set up alerts and reminders for upcoming tax deadlines.

Ensure timely payments of GST, income tax, and other taxes with integrated reminders.

Filing Historical Records:

Maintain a history of tax filings and invoice submissions for future reference and audits.

All data is stored securely within the system and can be accessed for compliance verification.

9. Audit & Reporting:

Comprehensive reporting tools for preparing financial statements, balance sheets, profit and loss reports, and tax audit reports.

Simplify tax audit preparation by generating and sharing key financial documents with auditors.

This Accounting Tax Filing & Invoice Management solution simplifies tax compliance and invoice management, helping businesses streamline their accounting processes and stay compliant with regulatory requirements.

Transaction management & Book Keeping

All transactions related to purchase, sales, inventory, production, Bank are captured in ERP. They can be edited, deleted whenever needed. Company maintains Profit/Loss Report, Balance Sheet, Cash Flow transactions, Bank transactions and reconciliation, Ledger wise transactions. User can track agewise billing, their payment/receipts, payable, receivables etc. ERP system shows monthwise GST and other opening and closing balances.

The output refers to the information generated by financial reports, used to analyze and present financial data. Some of the types of reports that can be generated by financial reports include:

- Income statement (P&L)

- Balance sheet

- Cash flow statement

- Accounts receivable and accounts payable reports

- Budget vs actual analysis

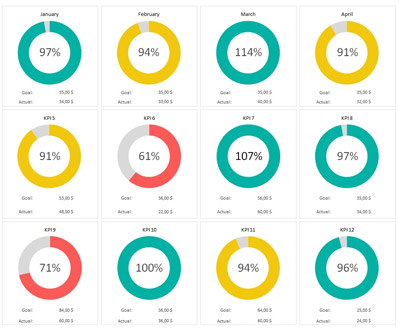

- Key performance indicators (KPIs)

- Profit and loss by product/service

- Trend analysis

Service Invoice

Service invoice management refers to the process of creating, storing, and tracking service invoices to ensure accurate billing and payment collection. This can include tasks such as:

- Generating invoices for services provided

- Sending invoices to customers

- Recording payments received

- Following up on overdue invoices

- Keeping accurate records of invoices and payments

- Providing reports and financial summaries of invoicing activity

Tax (GST) & TDS

Peacksoft ERP provides detailed tax management reports for GST and TDS to ensure complete tax compliance and accurate tracking of liabilities. Here's an overview of how these features work:

GST Reports:

1. Month-wise GST Breakdown:

The system generates monthly reports that show the total GST amount collected and paid.

GST is broken down into SGST, CGST, and IGST components, providing clarity on the distribution of taxes between state, central, and interstate transactions.

2. GST Tracking in Transactions:

Each purchase and sales transaction automatically records the applicable GST amounts.

GST is tracked for both Accounts Receivable (sales transactions) and Accounts Payable (purchase transactions).

The system keeps a detailed ledger of GST liabilities, ensuring that all tax data is accurately stored for filing purposes.

3. Accounts Receivable and Payable with GST:

Within the Accounts Receivable and Accounts Payable modules, users can easily track the GST component of each transaction.

These reports show how much GST is payable to the government based on sales and how much input tax credit (ITC) is available from purchases.

4. GST Compliance:

Peacksoft ERP automatically updates GST liabilities based on each transaction, making it easy to prepare for GSTR-1, GSTR-3B, and other returns.

All GST amounts are auto-populated in the tax filing module, reducing the risk of errors during manual filing.

5. TDS (Tax Deducted at Source) Management:

TDS Payable and Receivable:

The system maintains separate reports for TDS Payable and TDS Receivable, sourced from purchase invoices, input service invoices, and bank receipts that involve TDS.

The applicable TDS rates for each transaction are captured at the time of entry, ensuring compliance with tax regulations.

TDS Ledger:

Peacksoft ERP automatically updates the TDS ledger with amounts collected or paid based on each transaction.

This ledger keeps track of the TDS payable or receivable at any point in time, providing users with an overview of their TDS liability.

TDS Reporting:

Users can generate TDS reports to track the total TDS payable, amount paid, and outstanding liability.

The system aggregates all transactions within a given period to show the current TDS liability, ensuring businesses stay on top of their tax obligations.

TDS on Purchase/Service Invoices:

Transactions such as Purchase Invoices, Input Service Invoices, and Bank Receipts that include TDS will have the TDS rate applied automatically.

These transactions are aggregated to show the TDS liability over time in the TDS payable ledger.

Tax Liability Tracking:

Real-time updates ensure that both GST liabilities and TDS amounts are accurately reflected at any point in time.

The system provides historical records of all transactions, enabling businesses to review past liabilities and compare them with current ones.

With the help of integrated GST and TDS ledgers, users can track how much is payable, how much has been paid, and the remaining balance.

Comprehensive Tax Reporting:

The system provides monthly and periodic tax reports that combine GST and TDS data for easy tax filing.

The tax summary reports are useful for both internal reviews and external audits, ensuring that the business is fully compliant with tax regulations.

This tax filing and invoice management module ensures that businesses stay compliant with GST and TDS regulations, track liabilities accurately, and make timely payments to avoid penalties.

GSTR Filing

Peacksoft ERP simplifies the GSTR filing process with a few intuitive steps—prepare, upload, submit, and file. Here’s an overview of the process for filing various types of GSTR:

GSTR Filing Steps:

Prepare:

The system pulls all necessary transaction data (sales, purchases, credits, etc.) for a specific month or quarter.

Data is displayed in a format prescribed by the GST Council, ensuring compliance with statutory requirements.

Verification:

Users can review the data before filing, ensuring that it is complete and accurate.

Peacksoft ERP performs automatic validation checks, highlighting errors or missing information for the user to correct.

JSON Preparation:

Once the data is verified, the system allows users to generate the JSON format file, required for submission to the GST portal.

Users can download the JSON file for manual upload or choose to directly upload it to the GST portal from within Peacksoft ERP.

Upload:

If opting for direct upload, users can use the "Upload" button in the ERP’s GSTR filing preview to send the data directly to the GST portal.

This integration makes the filing process more seamless, reducing manual errors.

Submit and File:

After uploading the data, users can submit the filing and complete the process by entering the OTP sent to the registered mobile number.

Once the OTP is entered and validated, the filing process is complete.

Types of GSTR Filing Supported:

GSTR-1:

Return for outward supplies of goods and services, capturing details of sales and other outward transactions.

Peacksoft ERP extracts the sales data, including invoice-level details like B2B, B2C, and export sales.

GSTR-2:

Return for inward supplies or purchases, capturing details of goods and services received from suppliers.

The ERP auto-fetches purchase invoices and allows for matching with supplier-provided GSTR-1 data for input tax credit claims.

GSTR-3B:

Summary return for both sales and purchases on a monthly basis, reporting tax liability, input tax credit, and tax payment.

The ERP provides easy calculations of tax payable, ITC, and tax paid, ensuring compliance with monthly tax payment requirements.

GSTR-4:

Quarterly return for taxpayers opting for the Composition Scheme.

Peacksoft ERP extracts relevant transaction data and helps businesses under the composition scheme file their quarterly returns.

Benefits of Using Peacksoft ERP for GSTR Filing:

Ease of Use: The filing process is as simple as clicking a few buttons.

Error Validation: The system automatically checks for any errors or missing data, reducing filing mistakes.

GST Portal Integration: Direct upload to the GST portal eliminates the need for manual data entry.

Compliance: The reports are GST Council compliant, ensuring that users file accurate and complete returns.

Time-Saving: Automated data extraction and seamless integration help reduce the time spent on filing GST returns.

This automated process ensures accurate, timely, and hassle-free GSTR filing for businesses.

Get Started with Peacksoft ERP Today

Intuitive solutions on cloud with integrated features like Accounting, Purchase, Sales, Production, CRM, Payroll, Inventory & Filing of all compliances. . Call us at +91-86608 58802 (M: 9845167247) to schedule a consultation.

Manage sales through quotation by updating information and proceed to Sales order, Sales delivery , Sales invoice by click of few button.

Manage sales through quotation by updating information and proceed to Sales order, Sales delivery , Sales invoice by click of few button.

Manage Purchases through order by updating information and proceed to GRN, Purchase Invoice by click of few buttons.

Manage Purchases through order by updating information and proceed to GRN, Purchase Invoice by click of few buttons.

Comprehensive Inventory management features for small and mid size companies.

Comprehensive Inventory management features for small and mid size companies.

Manufacturing

Manufacturing