Peacksoft offers complete capabilities for your finance department starting from general ledger to reporting and ledger transactions, Receivables & Payables, Service Invoice management, Agewise Analysis.

Peacksoft Accounting

Accounting & Bookkeeping involves the day-to-day recording of all financial transactions. The work can be basic and administrative, but bookkeeping is at the financial core of a company. Bookkeeping includes the maintenance and balancing of ledgers, handling of accounts receivable and accounts payable and managing payroll. Bookkeeping is considered the first step in the accounting process. Accounting turns a collection of data into useful information that managers can rely on to determine the health of the business. Accounting focuses on the bigger picture and includes generating and analyzing financial statements, preparing and filing tax returns and providing forecasts and financial advice. Accounting software automates many traditional bookkeeping tasks.

Accounting & Bookkeeping tasks

- Recording transactions: Bookkeepers record every financial transaction in the general ledger, a master document that shows credits, debits and balances for each financial account. Bookkeepers often use double-entry accounting, a system that requires two balancing entries — one debit and one credit — for every transaction within a business to ensure accuracy.

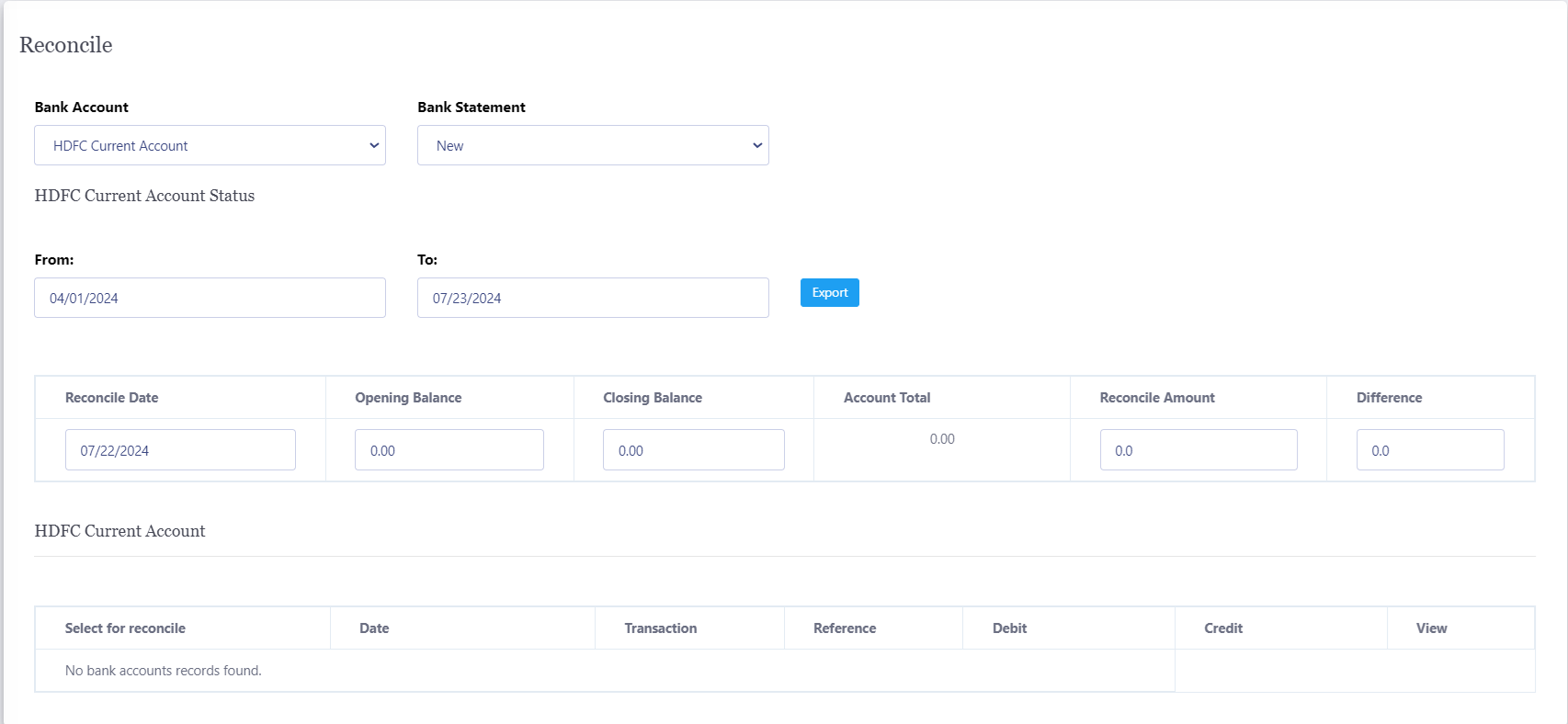

- Reconciling bank statements: This task, often handled monthly, involves matching recorded transactions in the bank account ledger and general ledger with bank statements to ensure that accounts are balanced.

- Account Receivable and Payable: Accounts receivable (AR) involves generating invoices, establishing terms of payment and tracking down overdue payments. Accounts payable involves making sure vendors are paid in a timely fashion.

- Managing payroll: Bookkeepers are often charged with reviewing employee time sheets, calculating deductions and processing payroll.

- Preparing adjusting entries: This task entails recording income and expenses that have occurred but aren't yet recorded in the bookkeeping process, such as interest earned but not yet received.

- Conducting audits: Accountants perform routine audits to ensure that financial statements and the books are following ethical and industry standards.

- Preparing and filing tax returns: Accountants are especially helpful during tax season. They handle tax planning, preparation and filing, which helps minimize tax liability and the chances of being audited by the ROC.

- Providing financial advice: Accountants can help business owners understand the impact of financial decisions and assess the health of the company.

Accounting Cycles

Bookkeepers record and organize financial data, and accountants analyze that information to provide business owners with important insights and financial advice. This is all part of the accounting cycle — the process businesses use to record and analyze their financial data. The goal of this process is to produce an accurate account of a company's financial health. Some of these steps are performed by a bookkeeper, some by an accountant and increasingly some are automated by accounting software.

- Identify and categorize transactions.

- Record journal entries.

- Post journal entries in the general ledger.

- Prepare an unadjusted trial balance.

- Make adjusting journal entries.

- Prepare an adjusted trial balance.

- Prepare financial statements like P&L, Balance Sheet, Cach Flow.

- Close The books.

Read more on Accounting & Tax Filing

Financial Transaction management

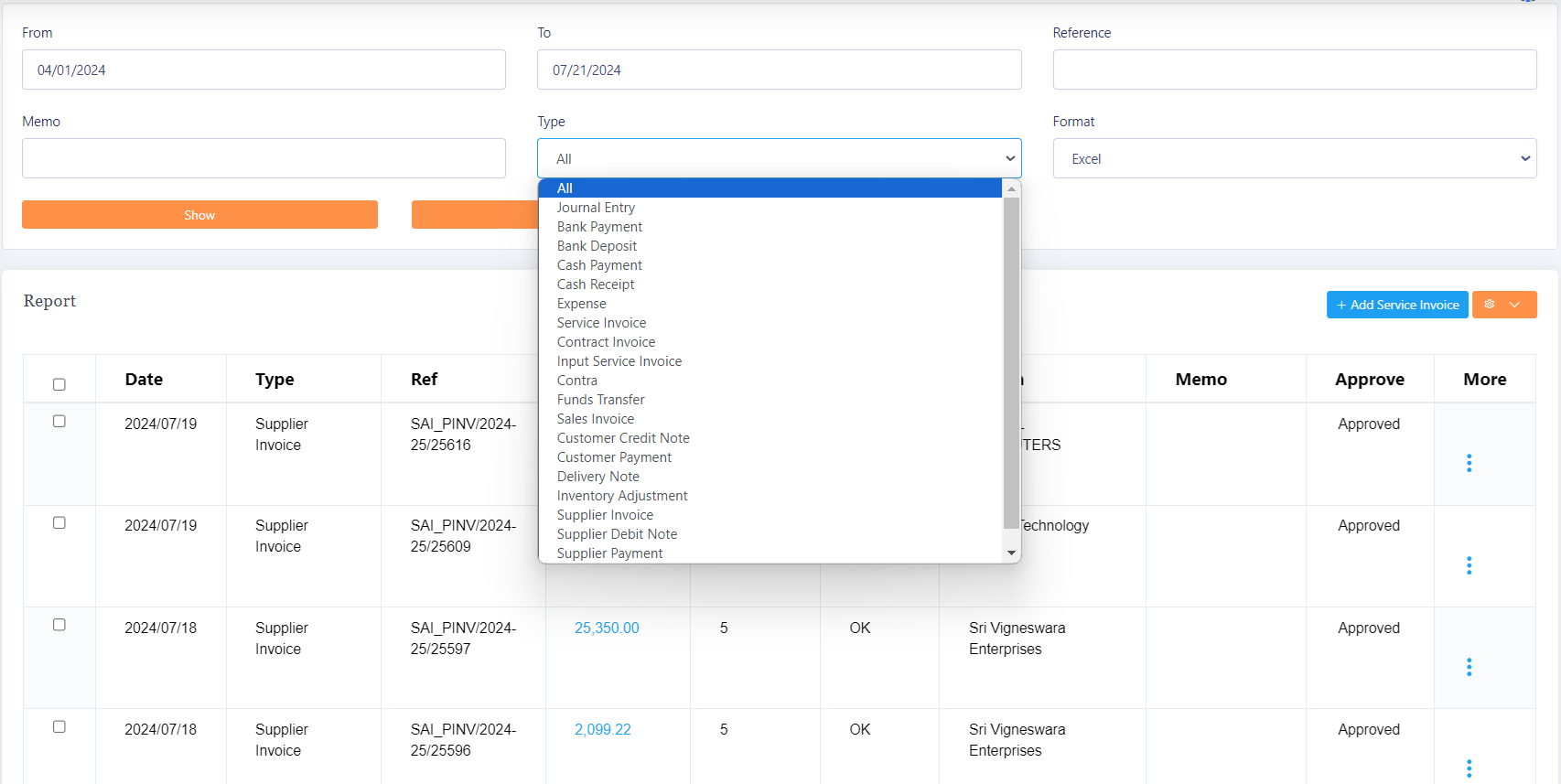

Financial Transaction management in Peacksoft ERP is about efficiently overseeing and coordinating various financial activities associated with business transactions. It ensures that all components, such as payments, shipments, invoicing, and related services, are handled accurately and systematically. Below are the key elements and types of transactions managed in the system:

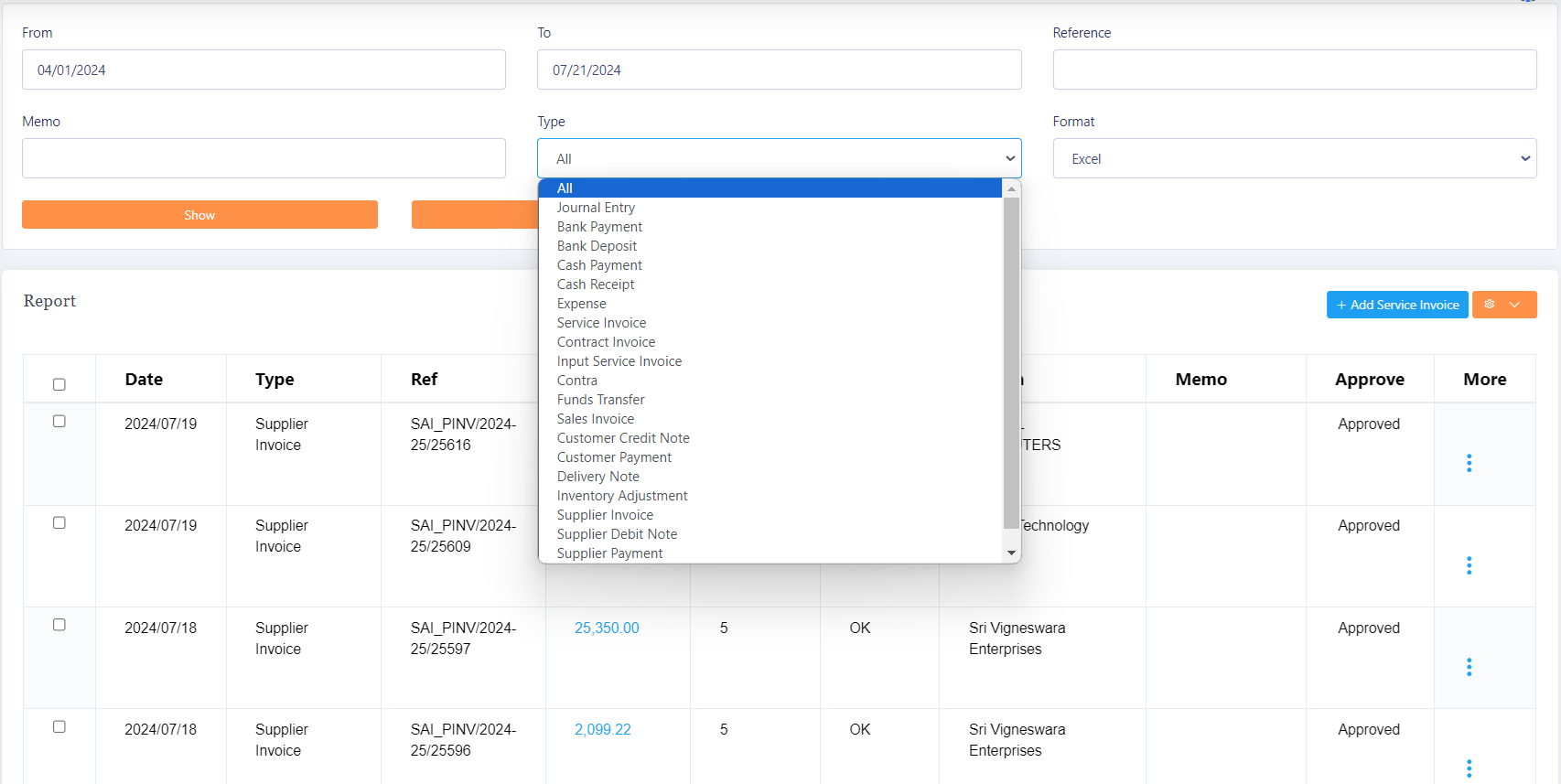

Types of Transactions:

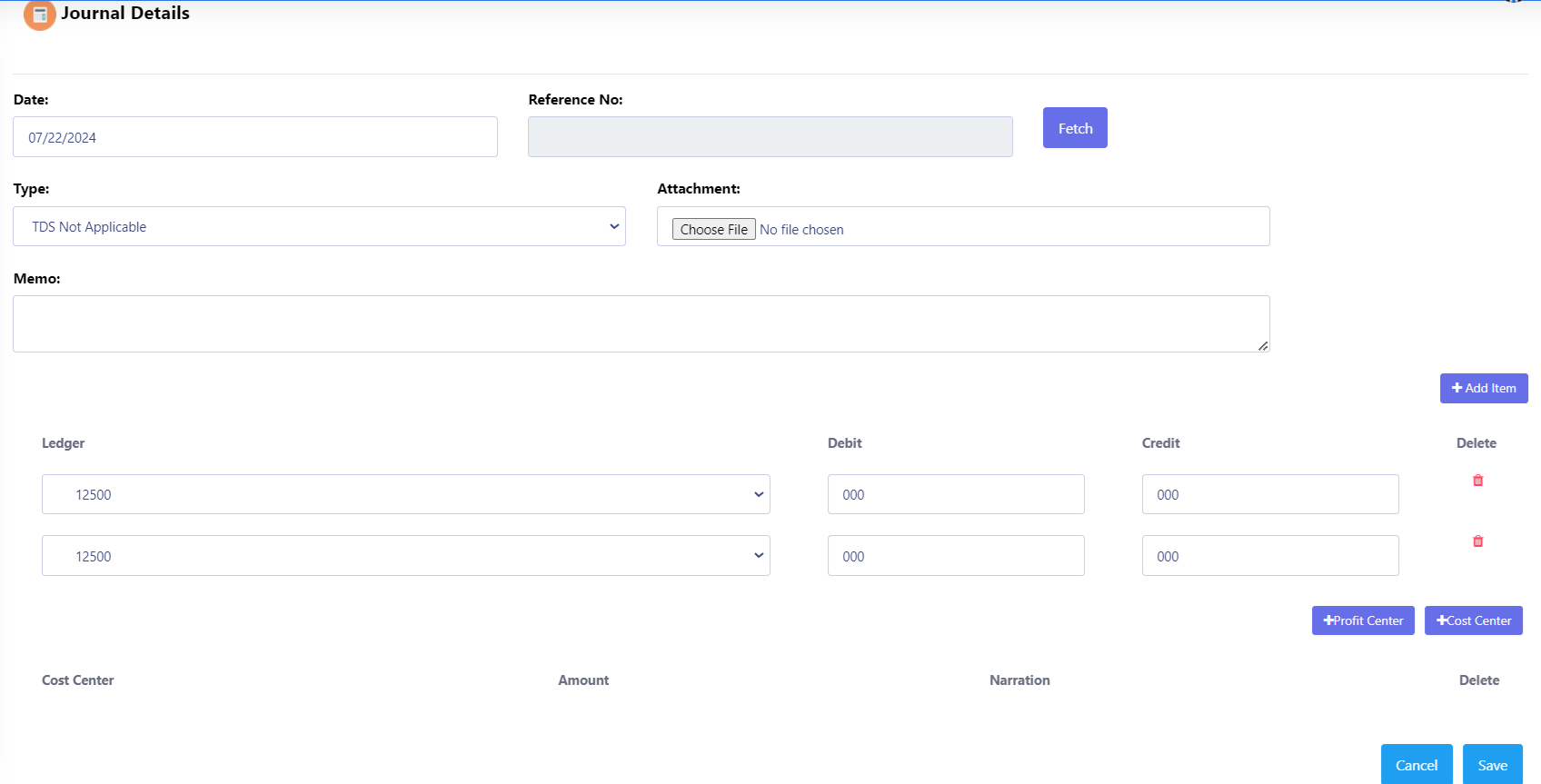

Journal Transaction:

Records any non-cash financial events (adjustments, internal transfers) in the company's ledger. This keeps the financial accounts balanced.

TDS Journal Transaction:

Specific transactions that deal with Tax Deducted at Source (TDS) deductions and adjustments, ensuring proper tax compliance.

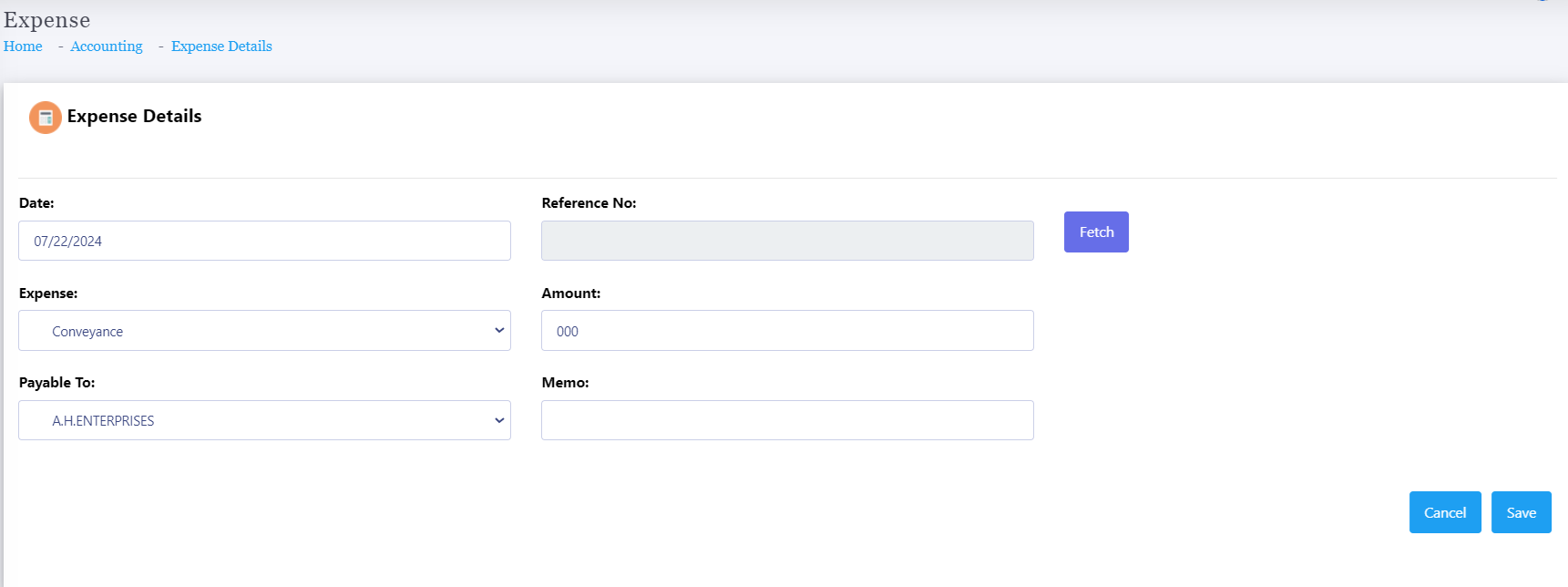

Expense Transaction:

Tracks business expenses incurred during operations, ensuring accurate accounting of costs.

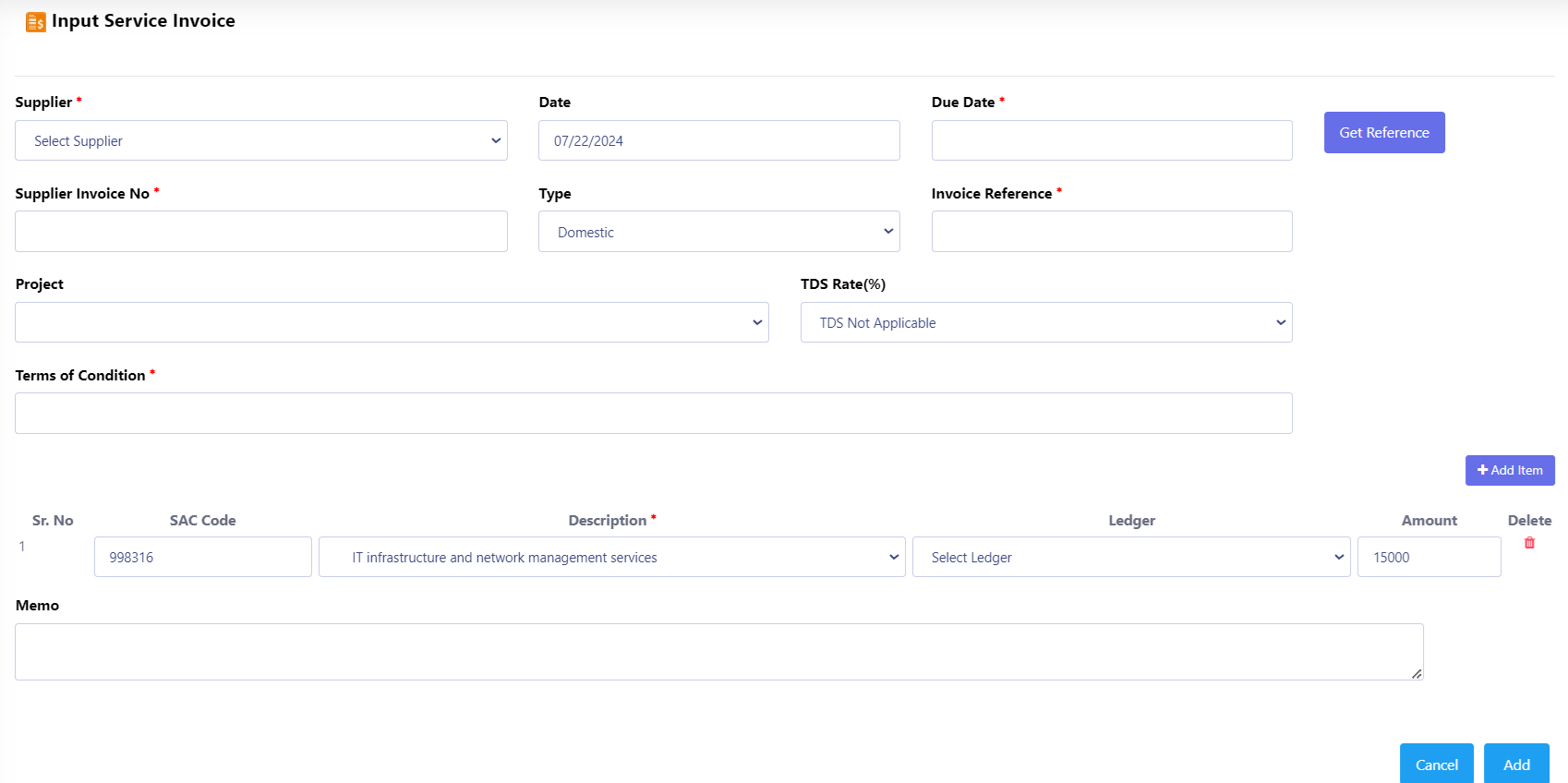

Input Service Invoice:

Documents services procured by the business and records these invoices in the system for proper accounting and tax adjustments.

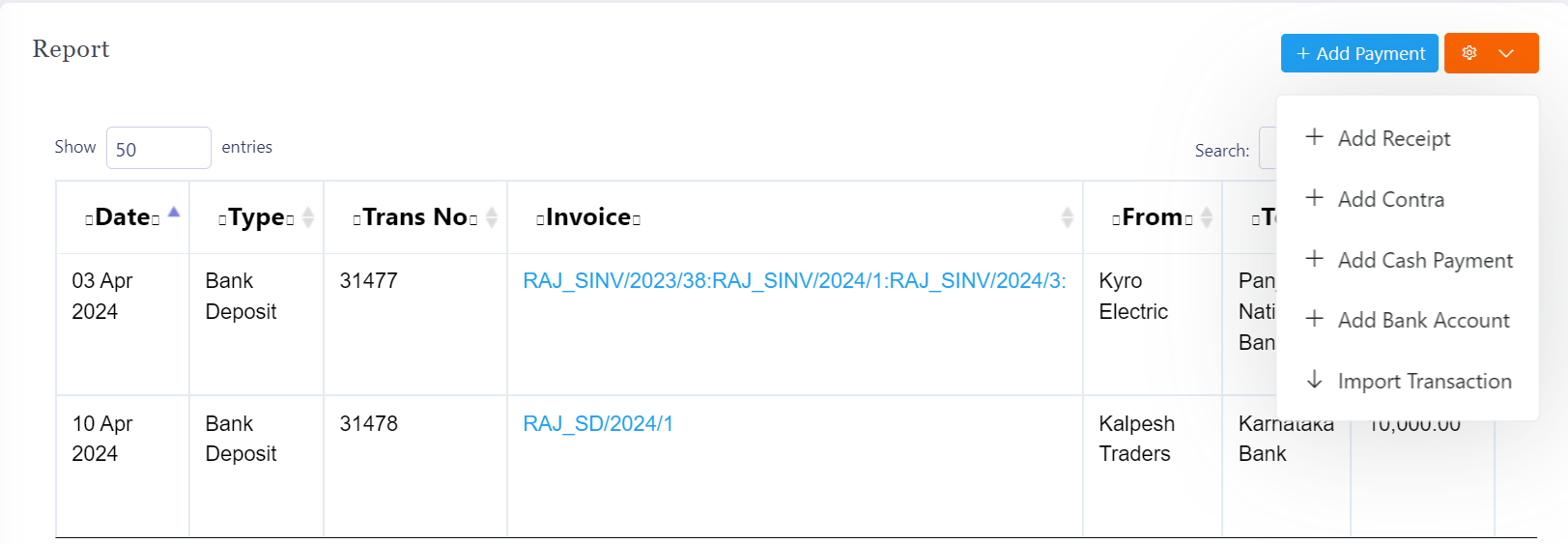

Bank Payment:

Records outgoing payments made through bank accounts, including vendor payments, employee salaries, etc.

Bank Deposit:

Records deposits made into the company’s bank accounts, helping in bank reconciliation.

Cash Payment:

Documents any cash payments made by the business, ensuring cash-based transactions are tracked properly.

Cash Receipt:

Records cash inflows received by the business from customers, other entities, or investments.

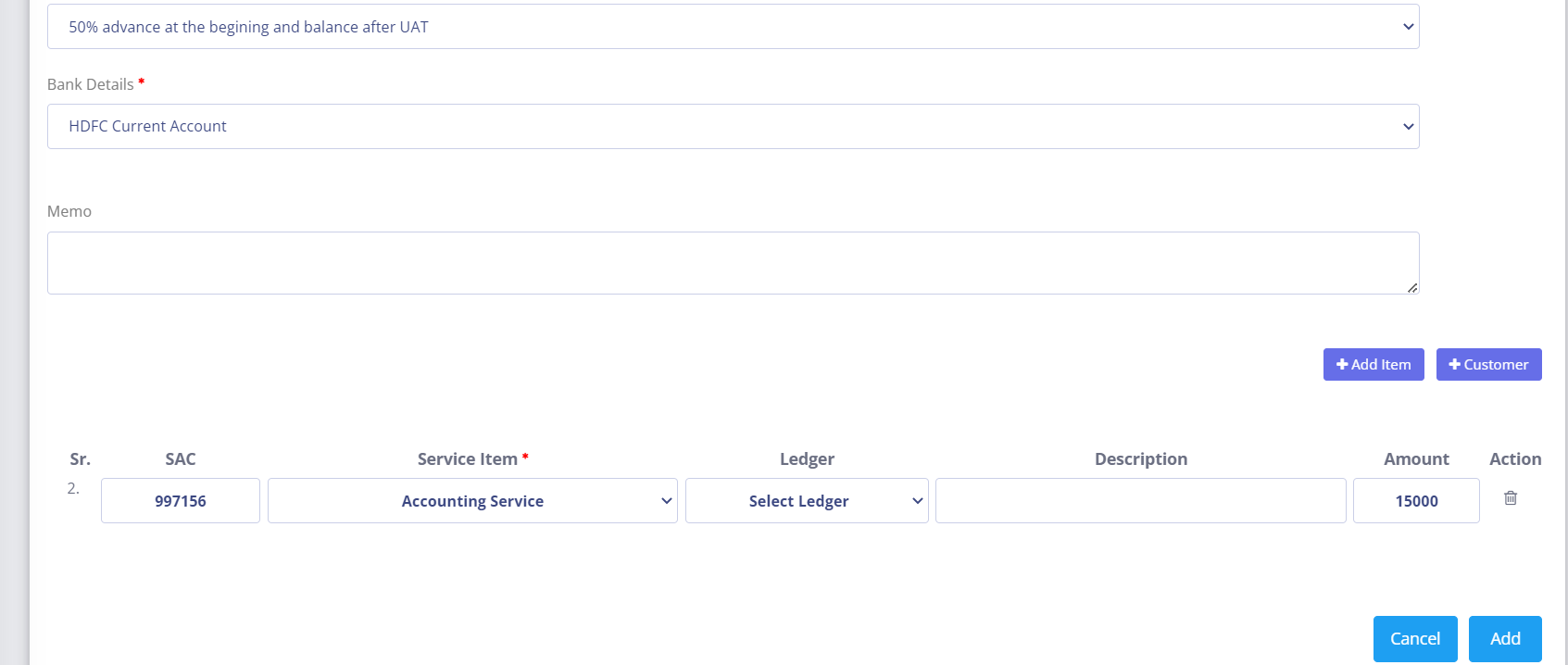

Service Invoice:

Creates invoices for services provided to clients or customers, ensuring accurate billing for non-product-related services.

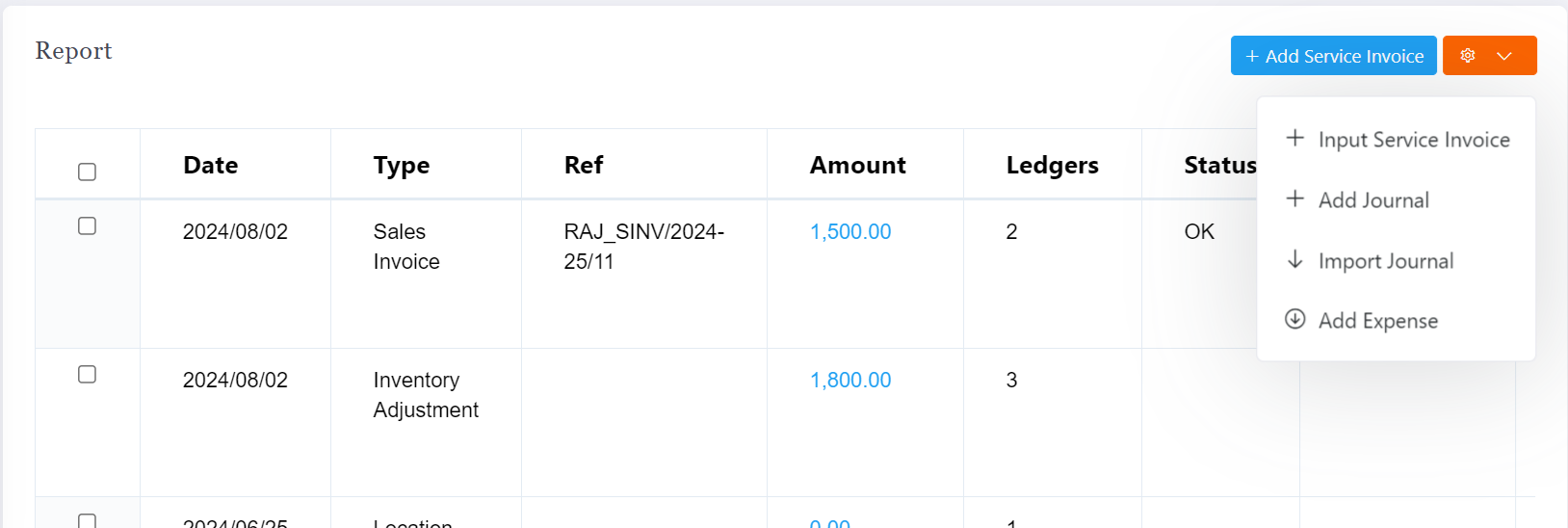

Import Transactions:

Peacksoft ERP allows importing various financial transactions to streamline processes and ensure accuracy across the system:

Journal Transaction Import:

Bulk import of journal entries into the system, helping speed up accounting processes for large volumes of adjustments.

Bank Transaction Import:

Import bank transactions to reconcile statements and automate bank ledger updates.

Service Invoice Transaction Import:

Import service-related invoices in bulk, simplifying the accounting for service-oriented businesses.

Purchase Invoice Import:

Bulk import of vendor or supplier invoices, allowing the company to automate accounts payable processing.

Sales Invoice Import:

Bulk import of sales invoices generated for customers, improving the efficiency of managing large sales volumes.

Bank Deposit Import:

Enables import of bank deposits, streamlining the reconciliation process with the company’s bank accounts.

Cash Payment Import:

Import bulk cash payment records to keep the accounting data accurate.

Cash Receipt Import:

Allows the import of multiple cash receipts, automating the record-keeping of received payments.

Service Invoice Import:

Bulk service invoice data import for quick access and recording in the system.

Ledger Group and Ledger Import:

Facilitates the import of ledger groups and individual ledgers, ensuring a structured and comprehensive chart of accounts.

Summary:

Transaction management ensures that every financial event, from payments to shipments to invoicing, is well-coordinated and accurately recorded. By importing transaction types in bulk, companies can automate their financial workflows, minimize errors, and ensure smoother business operations.

Service Invoice

Service invoice management is a crucial aspect of maintaining healthy cash flow and ensuring accurate billing practices for businesses that provide services. Here’s an overview of the key tasks involved in service invoice management:

Key Tasks in Service Invoice Management:

Generating Invoices for Services Provided:

Create detailed invoices that itemize services rendered, including descriptions, quantities, rates, and total amounts. This ensures customers clearly understand what they are being billed for.

Sending Invoices to Customers:

Distribute invoices to clients via email or other methods promptly after service completion. Automated systems can help streamline this process to ensure timely delivery.

Recording Payments Received:

Keep track of payments as they are received, updating invoice statuses to reflect whether they are paid, partially paid, or unpaid. This helps in maintaining accurate financial records.

Following Up on Overdue Invoices:

Monitor unpaid invoices and send reminders or follow-up communications to clients with overdue payments. This is essential for maintaining cash flow and ensuring timely payments.

Keeping Accurate Records of Invoices and Payments:

Maintain a centralized database that stores all invoices and payment records. This facilitates easy retrieval and auditing and helps in tracking the financial performance of service offerings.

Providing Reports and Financial Summaries of Invoicing Activity:

Generate reports that summarize invoicing activity, including total billed, payments received, outstanding invoices, and overdue amounts. These insights assist in financial analysis and forecasting.

Benefits of Effective Service Invoice Management:

Improved Cash Flow: Timely invoicing and follow-ups help ensure that payments are collected promptly, enhancing cash flow.

Accurate Financial Records: Keeping meticulous records of invoices and payments supports better financial management and reporting.

Customer Relationship Management: Clear and timely communication regarding invoices fosters trust and strengthens relationships with customers.

Efficiency in Operations: Automating the invoicing process reduces administrative burdens and the potential for errors, freeing up resources for other tasks.

Effective service invoice management is vital for businesses that rely on service provision. By implementing robust processes for generating, tracking, and managing invoices, companies can improve their billing accuracy, enhance cash flow, and maintain better relationships with their clients.

Financial reports

Financial reporting provides critical insights into a company's financial health by generating comprehensive reports. These reports help in analyzing, presenting, and making informed decisions based on financial data. Peacksoft ERP offers various types of financial reports, each serving a specific purpose:

Types of Financial Reports:

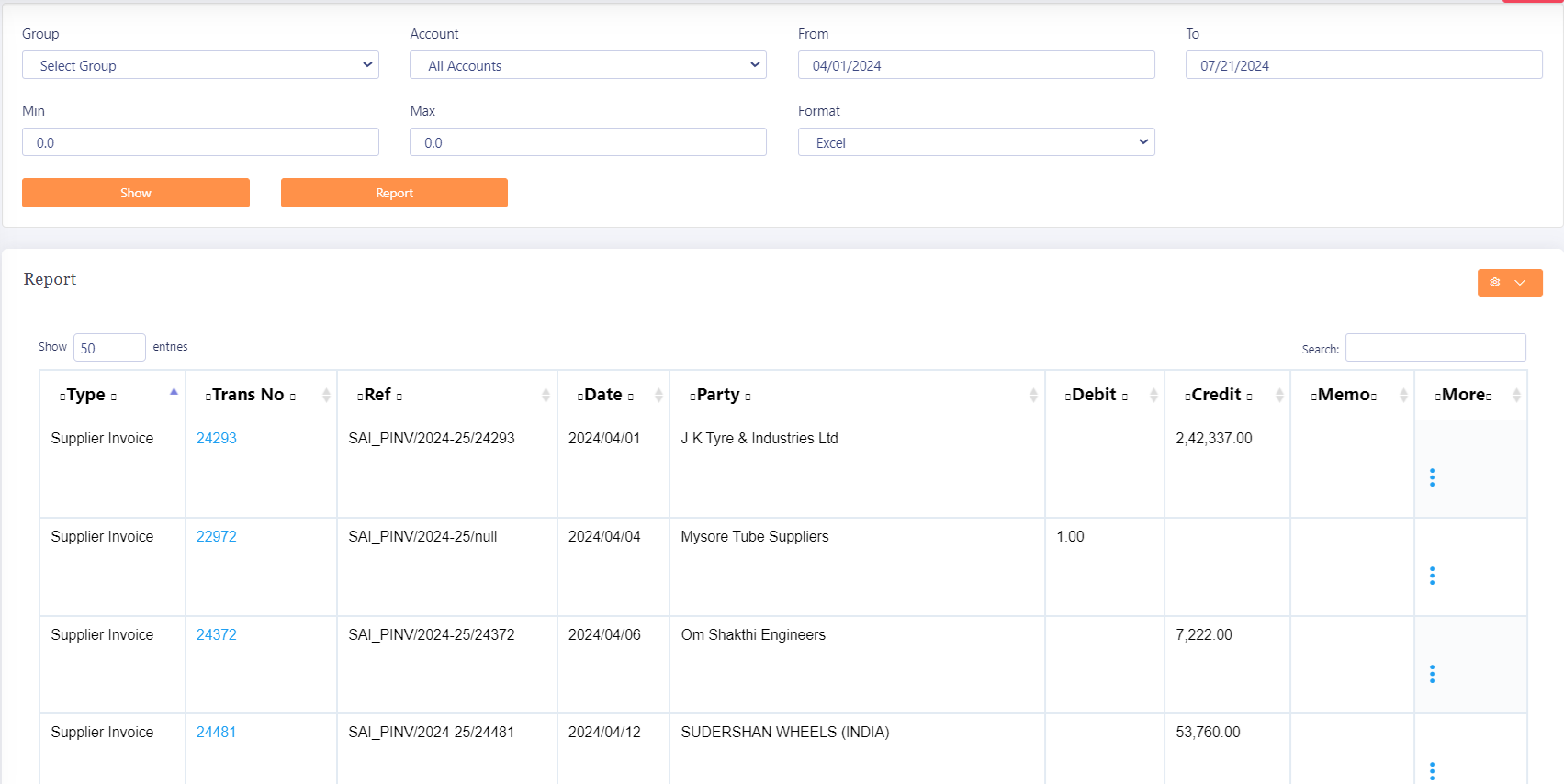

General Transactions for All Types of Vouchers:

This report displays all types of transactions (e.g., payments, receipts, journal entries) for a given period, helping track daily financial activities across the company.

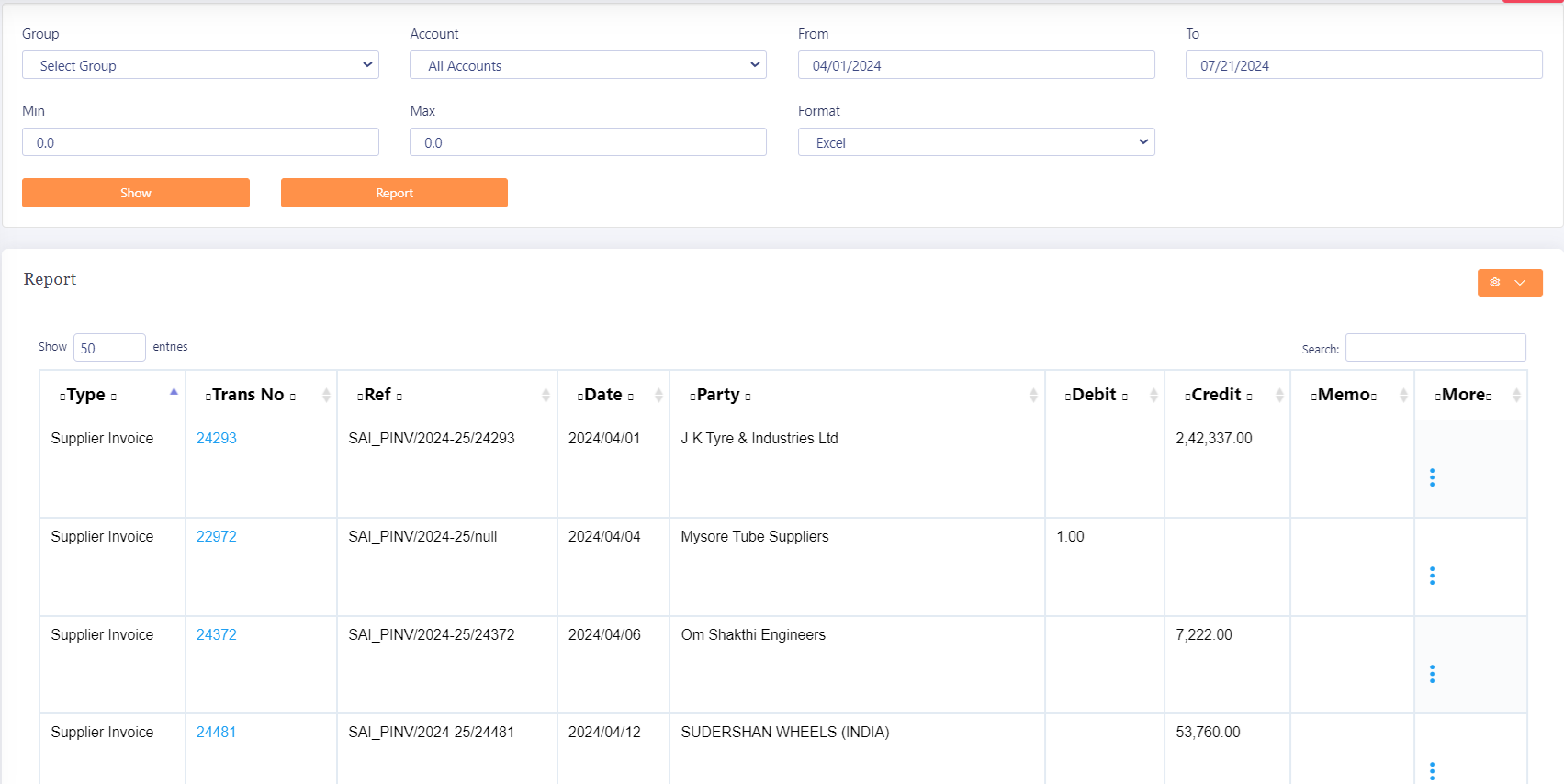

Ledger and Group-wise Transactions:

Detailed view of individual ledger accounts, along with group-wise categorization (e.g., assets, liabilities, income, expenses) to analyze financial performance by account or group.

Bank Transaction Reports:

This report provides an overview of all bank-related transactions, helping in reconciliation and management of bank accounts.

Age-wise Analysis of Receivables and Payables:

Breaks down outstanding receivables and payables by age categories (e.g., 30 days, 60 days), helping monitor overdue invoices and liabilities.

Income Statement (Profit & Loss):

Displays revenues, expenses, and net profit/loss over a specific period, providing a snapshot of the company’s financial performance.

Balance Sheet:

A summary of assets, liabilities, and equity at a specific point in time, offering a clear view of the company’s financial position.

Cash Flow Statement:

Tracks the inflow and outflow of cash, categorized into operating, investing, and financing activities, helping manage liquidity and cash reserves.

Accounts Receivable and Accounts Payable Reports:

AR reports show outstanding invoices owed by customers, while AP reports highlight outstanding amounts owed to vendors, aiding in cash flow management.

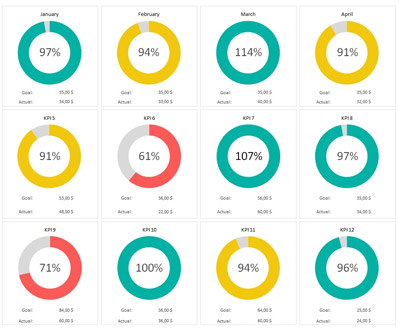

Budget vs Actual Analysis:

Compares the budgeted financial figures to the actual results, helping assess how well the company adheres to financial plans.

Key Performance Indicators (KPIs):

Customized financial metrics, such as gross profit margin, net profit margin, return on investment (ROI), and operating expenses, to gauge overall financial performance.

Profit and Loss by Product/Service:

This report provides a detailed profit and loss breakdown for each product or service, enabling more informed pricing, cost management, and profitability strategies.

Trend Analysis:

Analyzes financial data over a period of time, identifying trends in income, expenses, profitability, and cash flow, enabling proactive financial decision-making.

These reports are essential for financial planning, budgeting, auditing, and strategic decision-making, giving companies the tools to manage their finances effectively.

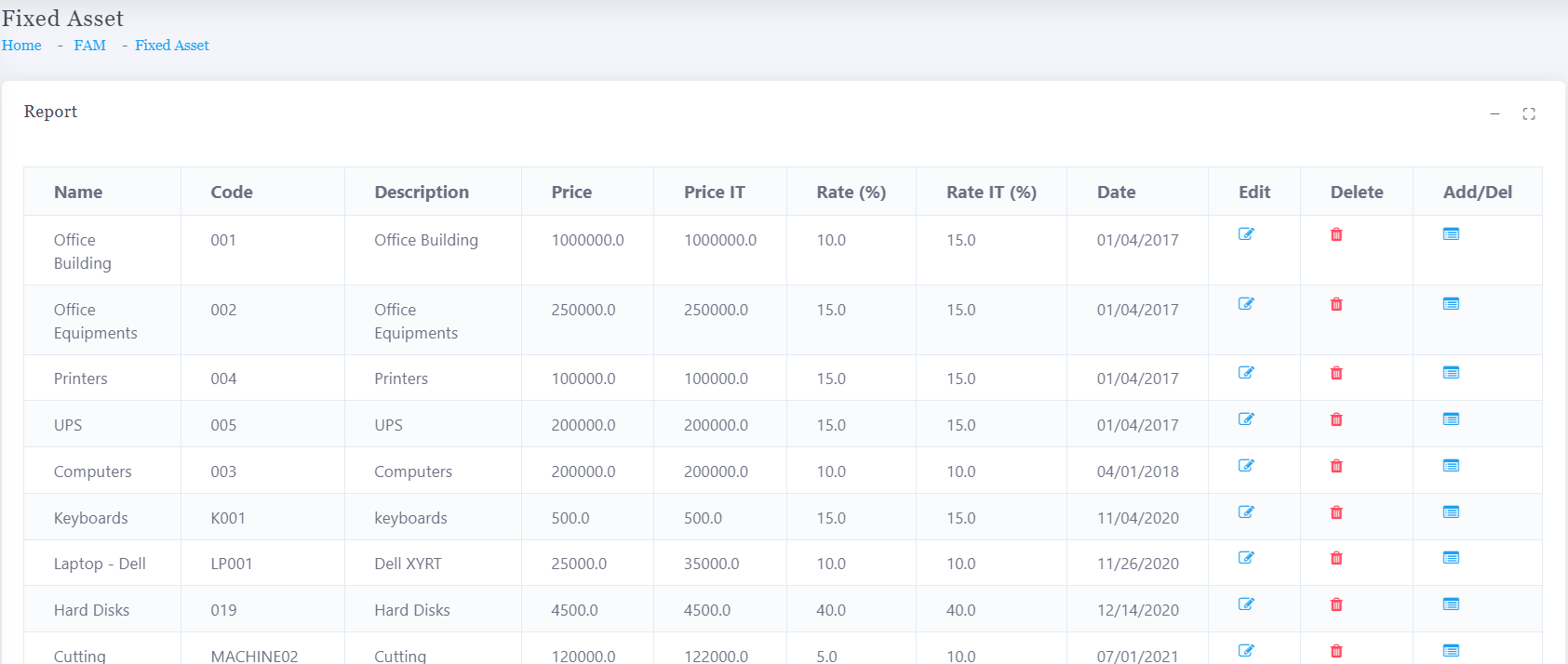

Fixed Asset Management (FAM)

Fixed Asset Management in Peacksoft ERP focuses on efficiently managing company-wide tangible and intangible assets, ensuring accurate tracking, compliance, and streamlined workflows. Here are the key features:

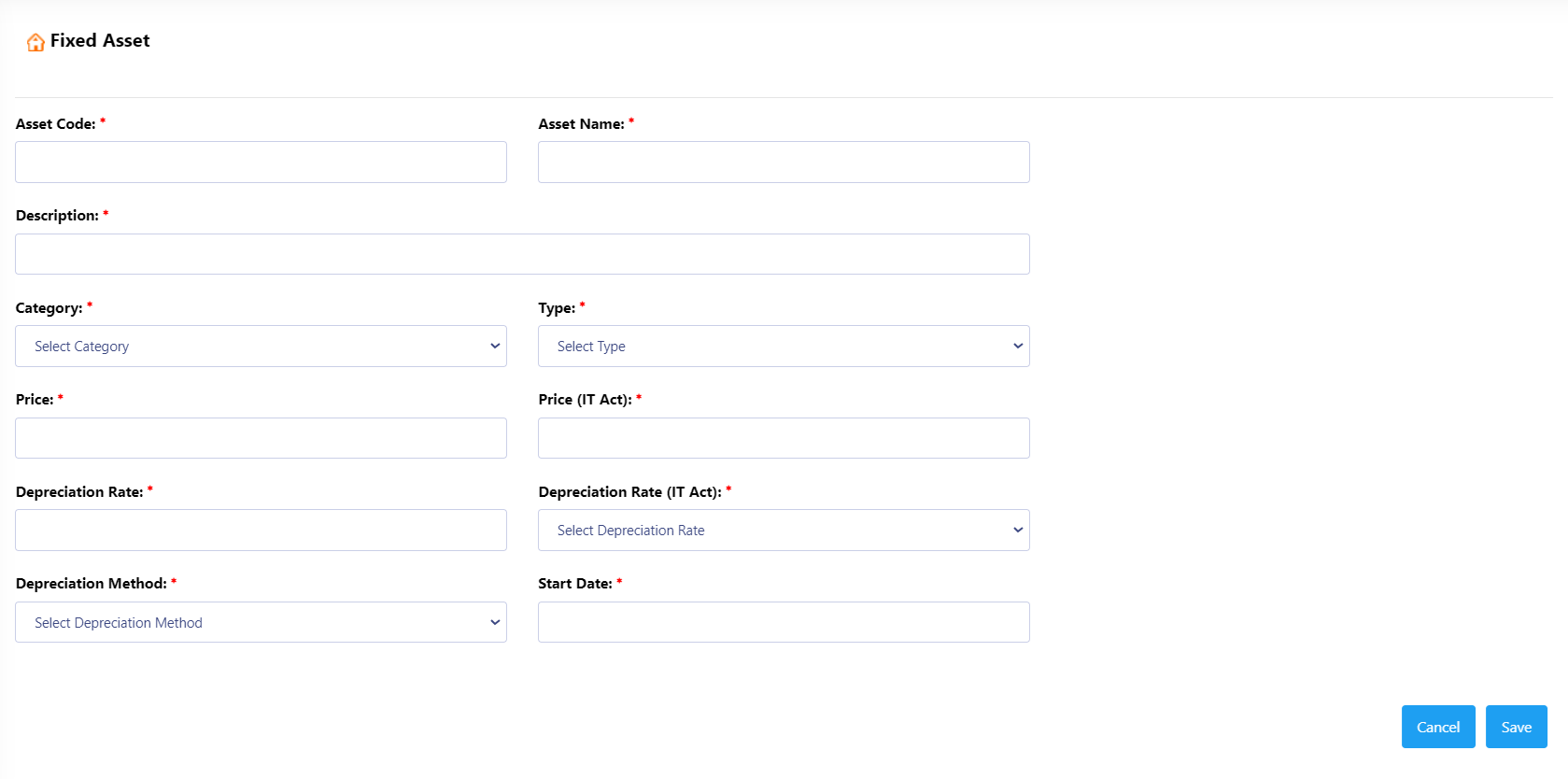

1. Asset Addition, Deletion, and Management:

Asset Addition: New assets like laptops, machinery, or intangible assets (e.g., software licenses) can be added to the system. Each asset is given a unique identifier for tracking.

Asset Deletion: When assets are no longer in use or need to be removed from inventory, they can be deleted from the system.

Asset Information Management: Users can update details like asset type, purchase date, vendor, cost, serial number, and location.

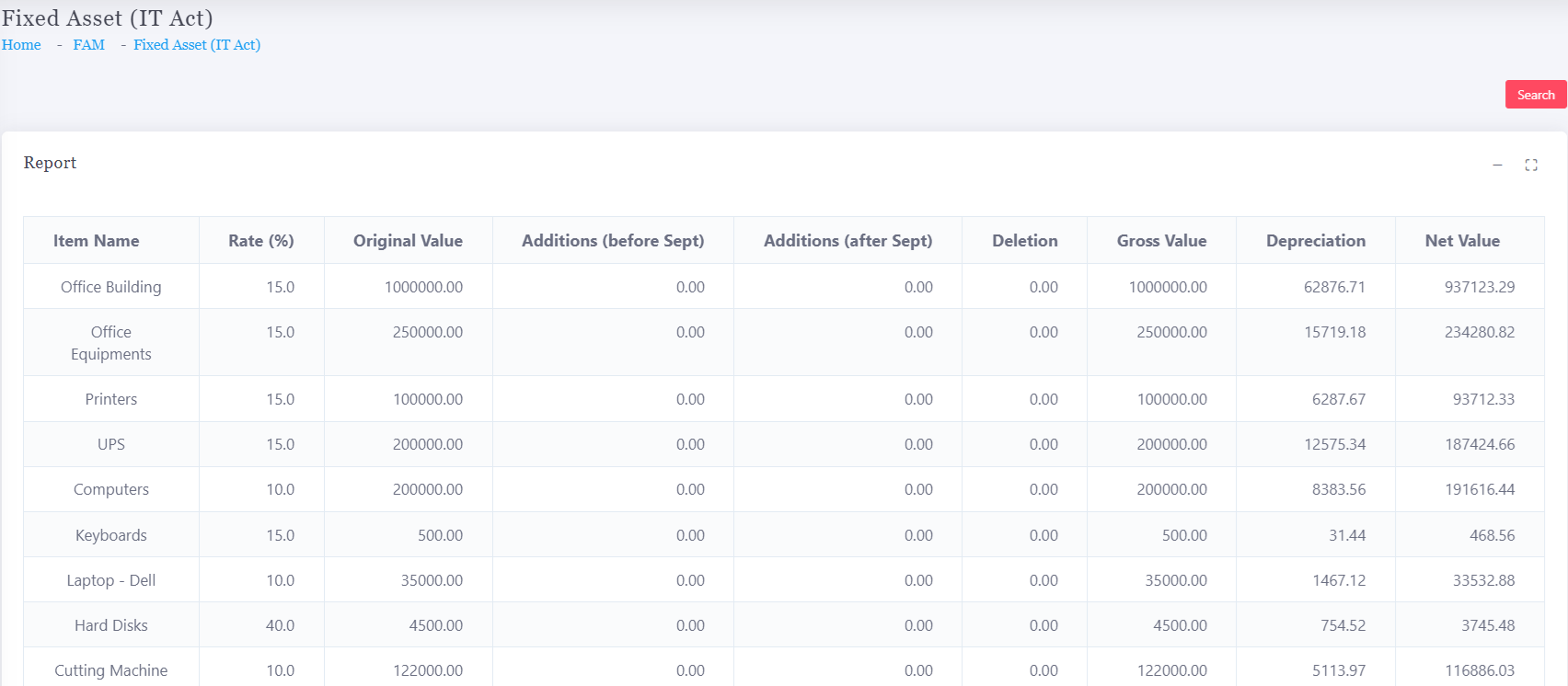

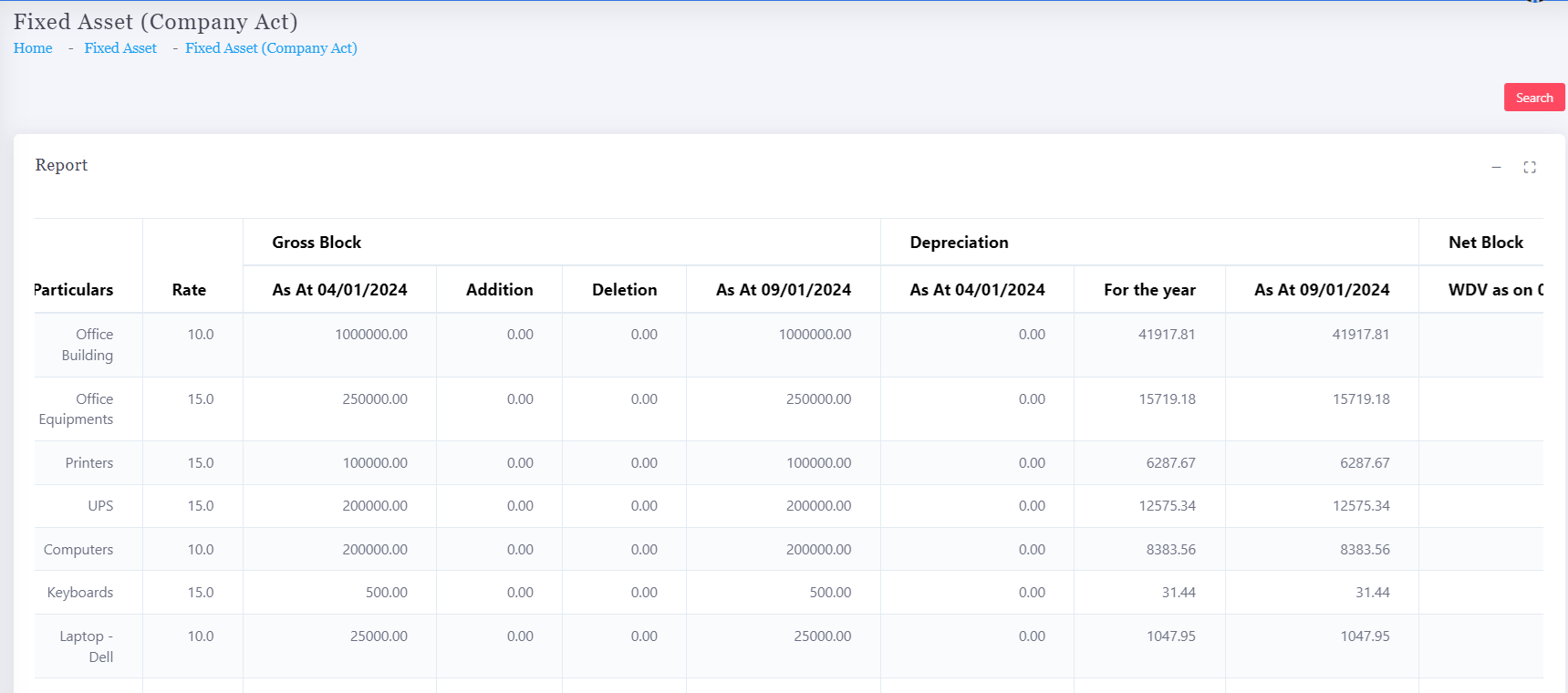

2. Asset Depreciation:

Depreciation as per Company Act: Depreciation is calculated following the rules specified by the Company Act, ensuring compliance with financial reporting standards.

Depreciation as per IT Act: The system also supports depreciation according to the Income Tax (IT) Act, helping companies align with tax requirements.

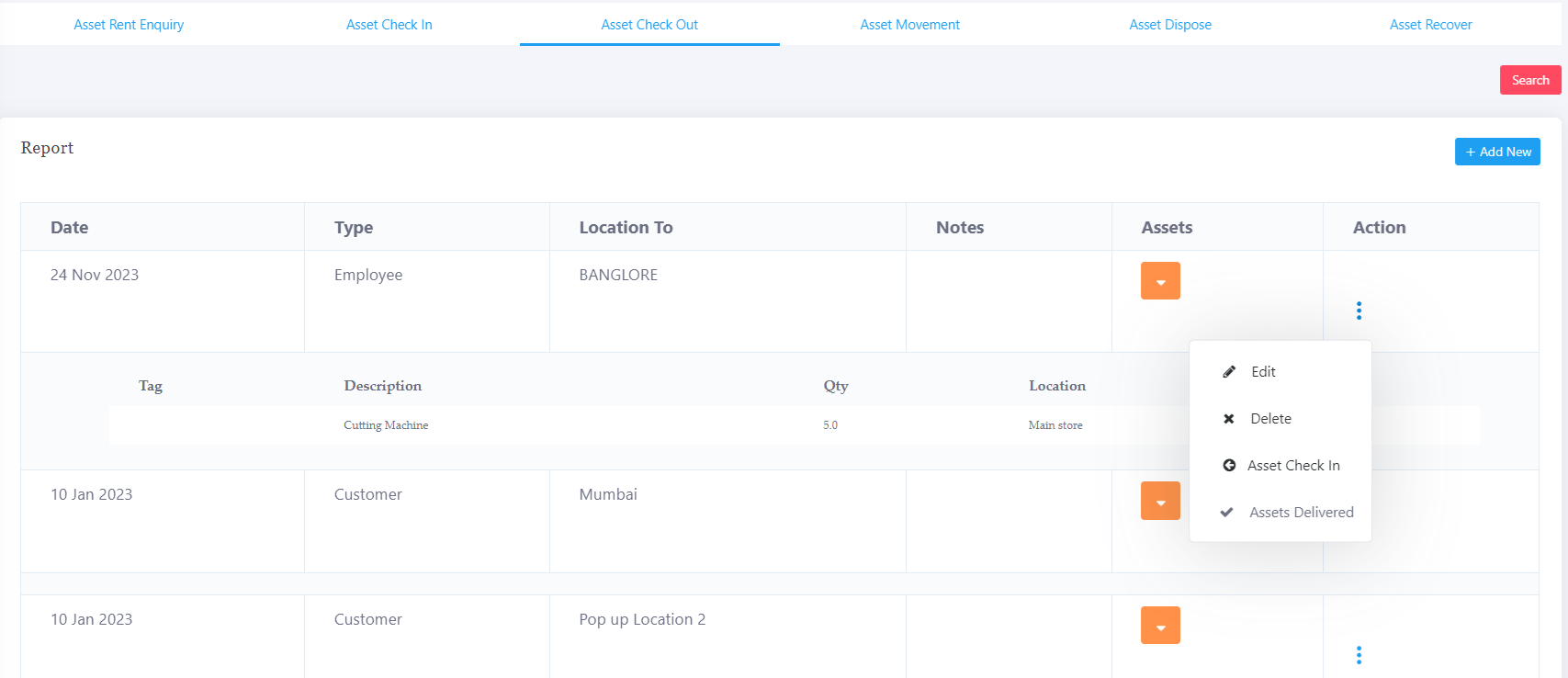

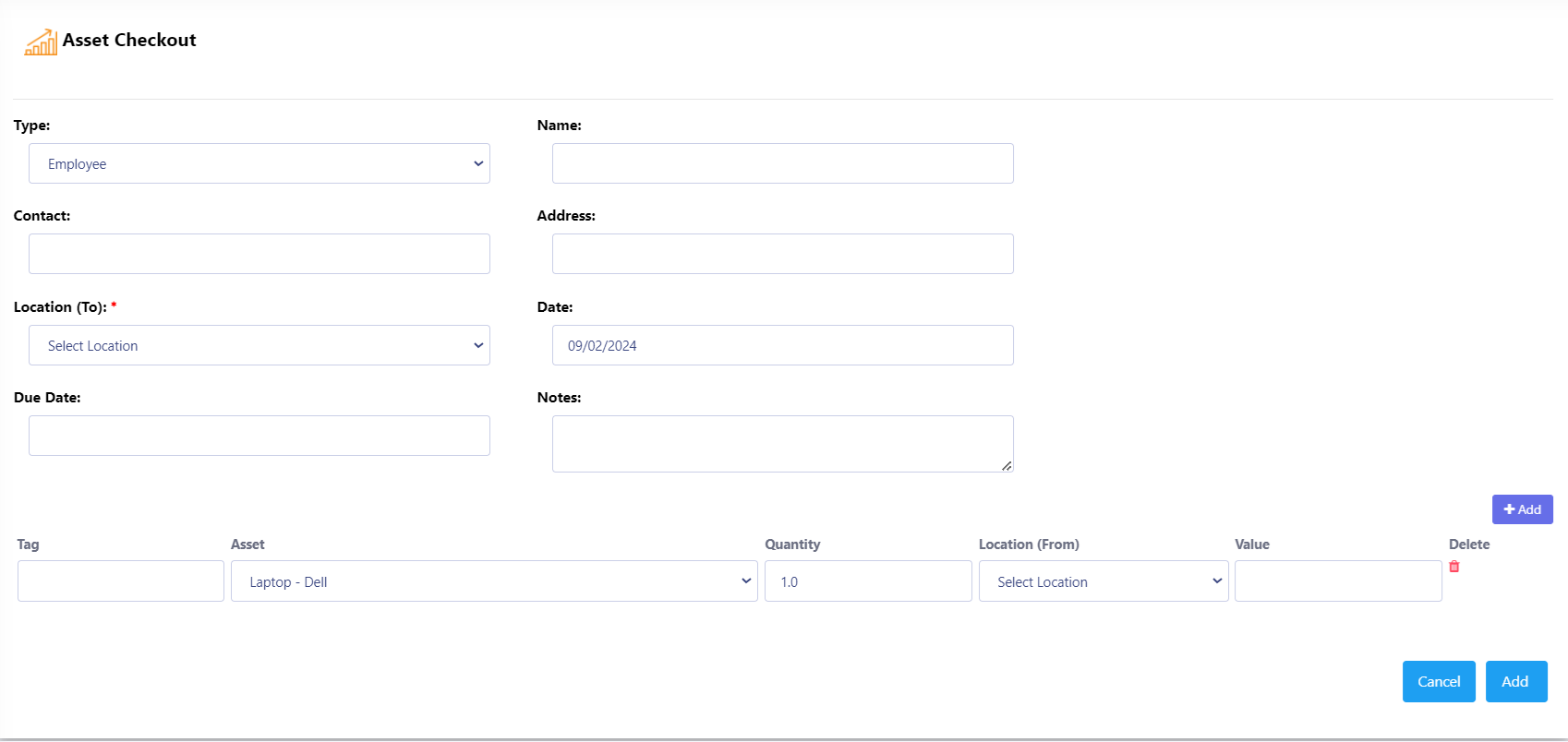

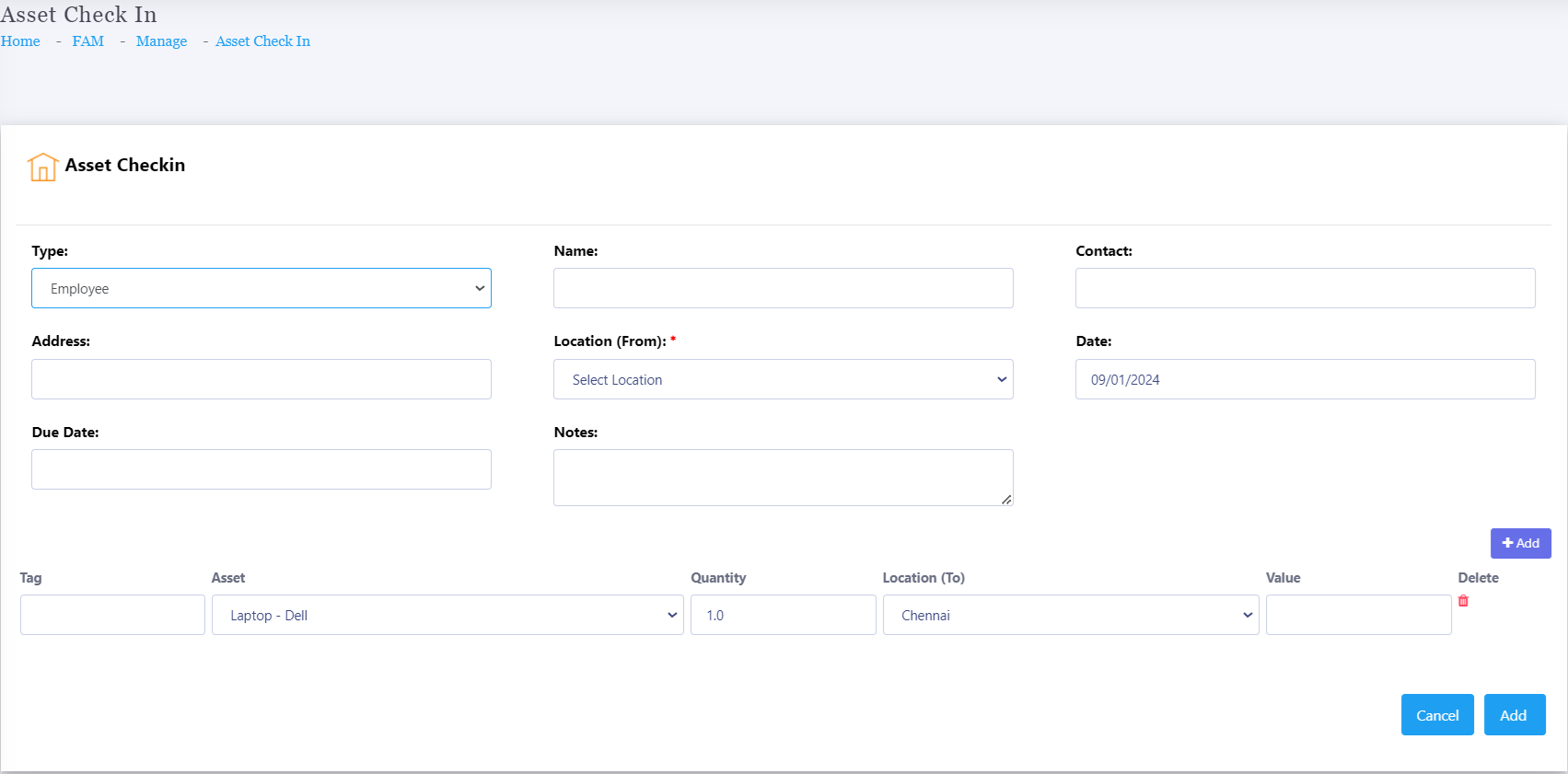

3. Asset Tracking (Check-Out/Check-In):

Check-Out: Assets that are loaned out to employees or departments (e.g., laptops) are marked as checked out.

Check-In: When assets are returned, the system tracks the check-in process, ensuring the asset is accounted for. This feature creates a complete asset usage and movement history.

Workflow Tracking: The system tracks the entire lifecycle of asset check-ins and check-outs, ensuring accountability and availability.

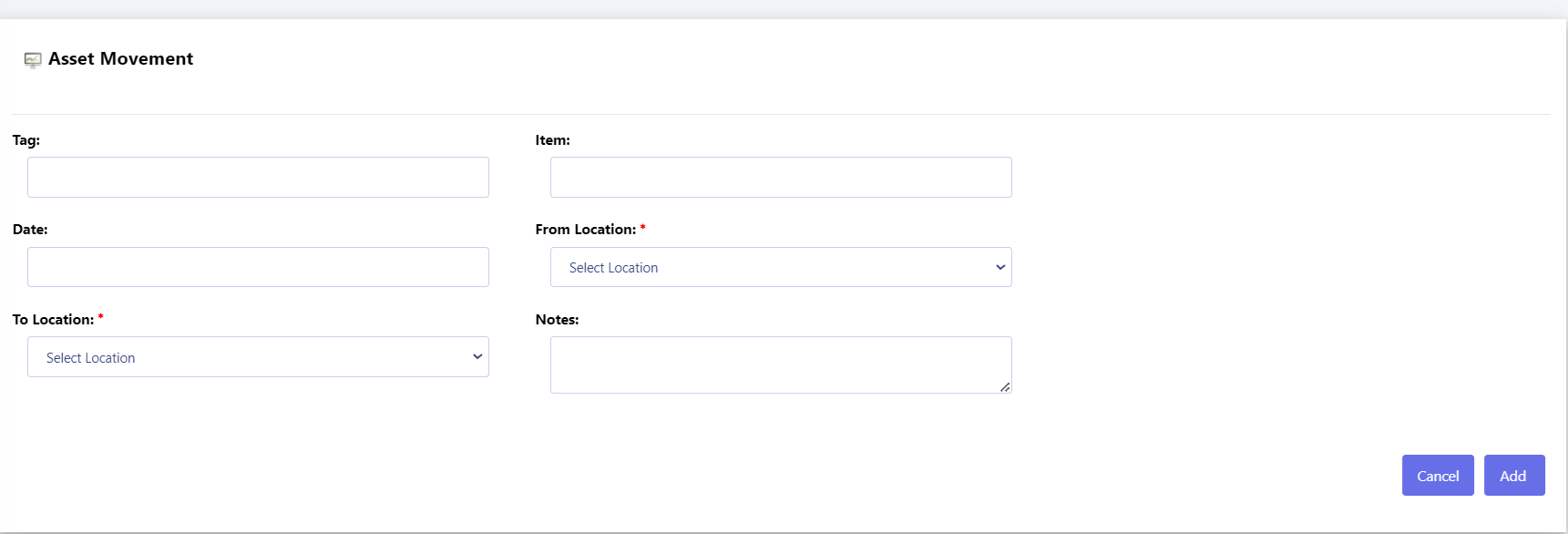

4. Asset Movement:

Inter-Location Transfers: Assets can be moved between company locations, and each movement is logged, ensuring assets are always traceable.

Movement History: A detailed record of asset movement is maintained to track the history of each asset across departments or locations.

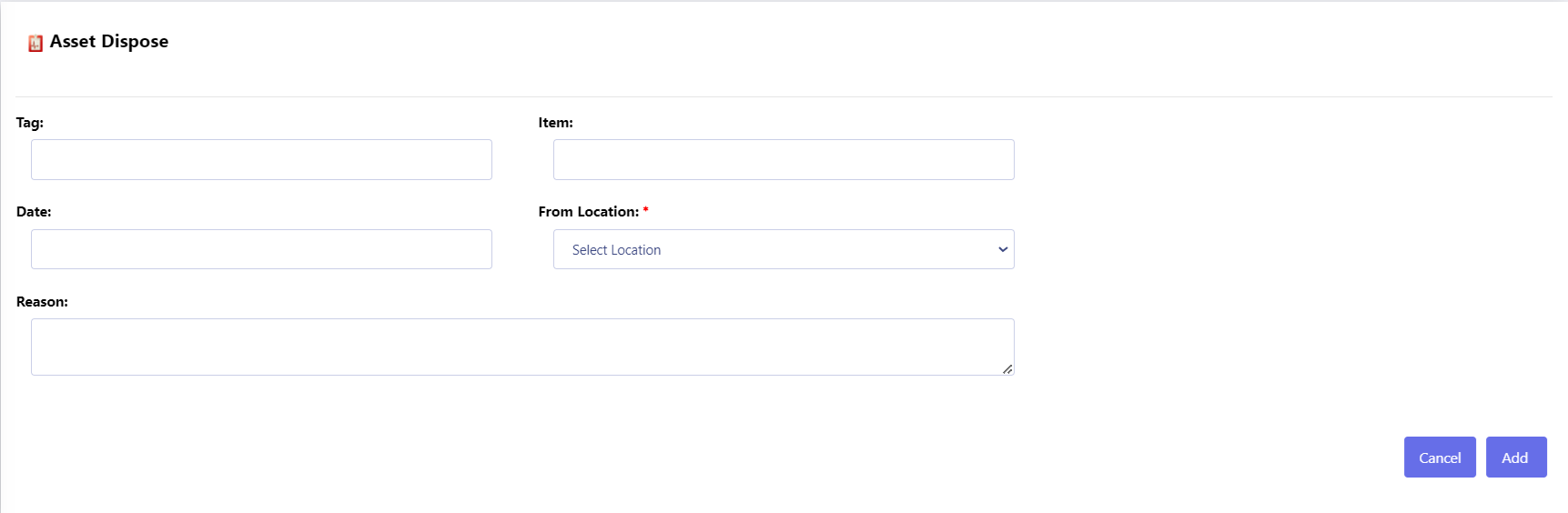

5. Asset Disposal and Recovery:

Disposal Management: When assets reach the end of their useful life, the system supports the process of disposal, whether through sale, donation, or recycling.

Asset Recovery: If an asset is reclaimed or reconditioned, the system tracks its recovery and re-entry into the inventory.

6. Asset Rent Management:

Rent Management: The system allows companies to rent out assets (e.g., machinery, equipment) and track rental agreements, including duration, cost, and return schedules.

Tracking of Rental Agreements: Each rented asset’s status is monitored until it is returned, ensuring proper rent management and usage oversight.

7. Integration with SCM (Supply Chain Management) Modules:

Seamless Integration: Fixed Asset Management integrates with SCM modules to ensure smooth asset-related transactions like asset purchasing, movement, and inventory updates.

Supply Chain Operations: This integration helps keep assets in sync with stock items, purchase orders, and warehouse management systems.

8. Asset Movement to Stock Item Delivery Challan Management:

Delivery Challan: When an asset is moved (e.g., to another location or a subcontractor), the system automatically generates a delivery challan to document the transfer.

Stock Item Integration: If assets are managed as part of the stock, their movement is logged similarly to stock items, allowing for efficient warehouse and inventory control.

With these features, Peacksoft ERP's Fixed Asset Management system provides a comprehensive solution for tracking, managing, and reporting on company assets, ensuring compliance, transparency, and streamlined processes across departments.

Get Started with Peacksoft ERP Today

Intuitive solutions on cloud with integrated features like Accounting, Purchase, Sales, Production, CRM, Payroll, Inventory & Filing of all compliances. . Call us at +91-86608 58802 (M: 9845167247) to schedule a consultation.

Manage sales through quotation by updating information and proceed to Sales order, Sales delivery , Sales invoice by click of few button.

Manage sales through quotation by updating information and proceed to Sales order, Sales delivery , Sales invoice by click of few button.

Manage Purchases through order by updating information and proceed to GRN, Purchase Invoice by click of few buttons.

Manage Purchases through order by updating information and proceed to GRN, Purchase Invoice by click of few buttons.

Comprehensive Inventory management features for small and mid size companies.

Comprehensive Inventory management features for small and mid size companies.

Manufacturing

Manufacturing