Employee Management

The Hiring and Onboarding process within the Peacksoft HR module is designed to streamline employee recruitment, selection, and onboarding, while capturing key employee details and ensuring compliance. Here's a detailed overview of the features:

Employee Personal and Professional Data Management:

Employee Personal Information: The system captures key personal details of employees, including name, date of birth, contact information, address, identification documents, and emergency contacts.

Compliance Details: Employees' compliance-related information, such as tax details, statutory compliance (PF, ESIC), and other legal requirements, are managed to ensure full compliance with local laws.

Bank Information: The system captures employees’ banking details, including account numbers, bank names, and IFSC codes, facilitating accurate salary payments.

Salary Details: Employees’ salary structures, allowances, deductions, and benefits are stored and can be managed or updated as needed. The salary breakup includes both fixed and variable components.

Hiring Process:

Job Requisition:

1. When a new position opens, a job requisition is added to the HR system. The requisition includes job details, department, required skillset, and experience level.

2. Hiring managers and HR personnel can collaborate on setting the job criteria, ensuring the required skills, qualifications, and job descriptions are defined accurately.

Candidate Management:

1. Candidates for each requisition are sourced from various channels such as job portals, employee referrals, or direct applications. Each candidate's resume, qualifications, and experience details are captured and maintained within the HR system.

2. The system allows HR to track the status of each candidate across different stages of the hiring process, from application to final decision.

Interview and Selection:

Interview Scheduling: HR can schedule interviews and track the interview process across multiple rounds. Interviewers are assigned to each round, and feedback is recorded.

Evaluation and Feedback: Managers record comments, ratings, and feedback for each candidate after each interview round. These evaluation metrics are used to assess the candidate's suitability for the role.

Final Selection: Based on interview feedback and evaluation, a decision is made to either select or reject the candidate. All steps are documented for future reference.

Job Offer Generation:

1. Once a candidate is selected, the HR system generates a formal job offer, which includes the salary breakup, joining date, and job details. The system supports customization of offer letter templates to align with the organization's format and policies.

2. Salary Breakup Annexure: An annexure detailing the complete salary structure (basic, allowances, bonuses, deductions, etc.) is attached with the job offer. This provides transparency on the compensation package.

Employee Onboarding:

Employee Master Data Entry:

1. After the offer is accepted, the onboarding process is initiated, where HR records all employee information in the system. This includes personal, educational, compliance, banking, and salary data.

2. The system helps manage the new employee's documentation, such as ID proofs, educational certificates, previous employment records, and other necessary onboarding documents.

Salary Data:

1. The salary structure entered during onboarding is recorded in the system and becomes the basis for payroll processing. The system allows HR to track any future salary revisions, bonuses, and other pay-related changes.

The entire hiring and onboarding process is designed to be seamless, ensuring smooth transitions from candidate sourcing to employee onboarding. Additionally, it allows HR to track and maintain compliance while ensuring that all employee data is centrally managed and accessible for future references.

Salary Management

Salary Management in Peacksoft Payroll is highly configurable and flexible, allowing companies to handle a wide range of salary structures and processes. Here's a detailed breakdown of the key features:

Configurable Salary Structure:

Flexible Salary Structures: Peacksoft Payroll offers the flexibility to create different salary structures tailored to each employee or job role. This allows HR departments to define various salary components (such as basic pay, HRA, allowances, bonuses, etc.) based on company policies.

Unlimited Salary Components: Users can add an unlimited number of salary components, enabling precise customization of payroll for various employee categories. Each component can be defined as fixed or variable, taxable or non-taxable.

Investment Details: Employees can input their tax-saving investments, such as insurance, provident funds, and other deductions. The system factors these investments into the final tax calculation.

Salary Advance:

Record Advances: The system allows HR to record salary advances taken by employees. These can be tracked easily, ensuring that no payments are overlooked.

Advance Recovery: The system supports equated monthly installment (EMI) recovery for salary advances. It can automatically deduct the required amount from monthly payroll until the advance is fully recovered.

Claims:

Expense Reimbursement: The system can record employee claims and reimbursements for expenses such as travel, meals, and business-related bills. Employees can submit claims with supporting documents, and HR can track, verify, and approve these claims.

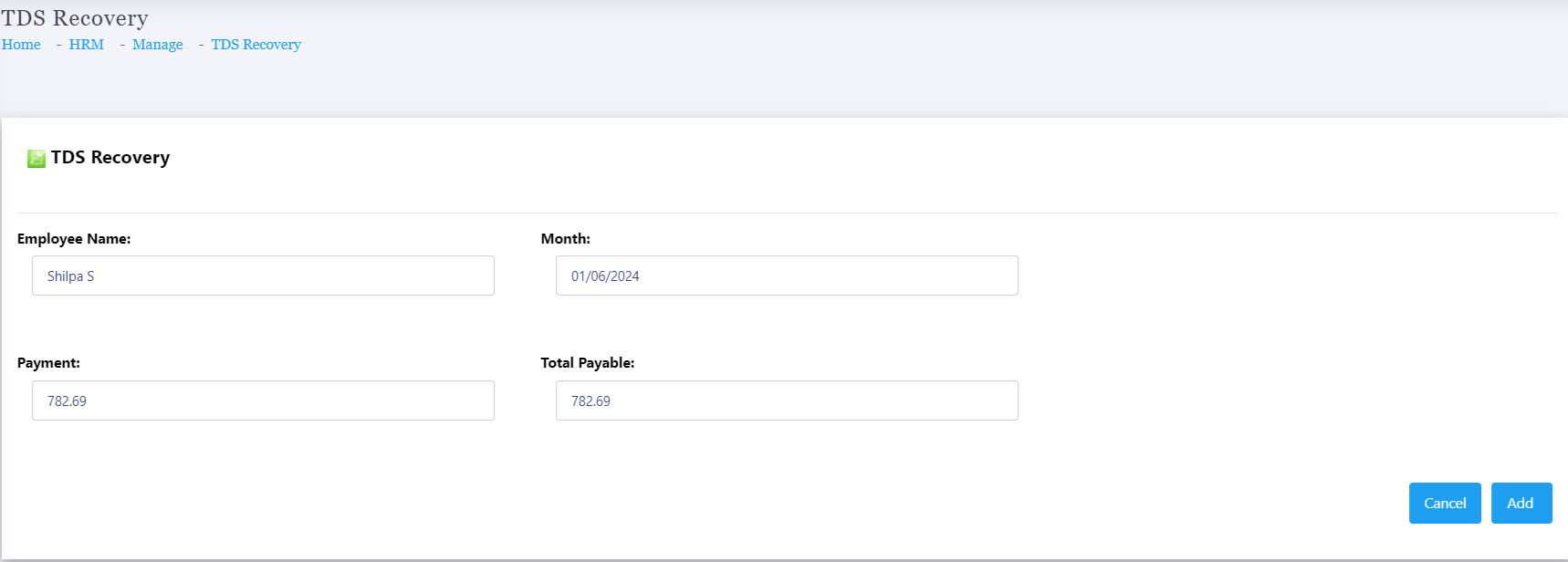

TDS Recovery:

Monthly TDS Recovery: Peacksoft Payroll captures the employee’s monthly Tax Deducted at Source (TDS) recovery, ensuring that accurate deductions are made as per government regulations.

Compliance with Tax Laws: The system is designed to comply with statutory tax laws and automatically calculates monthly TDS based on the employee’s salary, investment details, and applicable tax brackets.

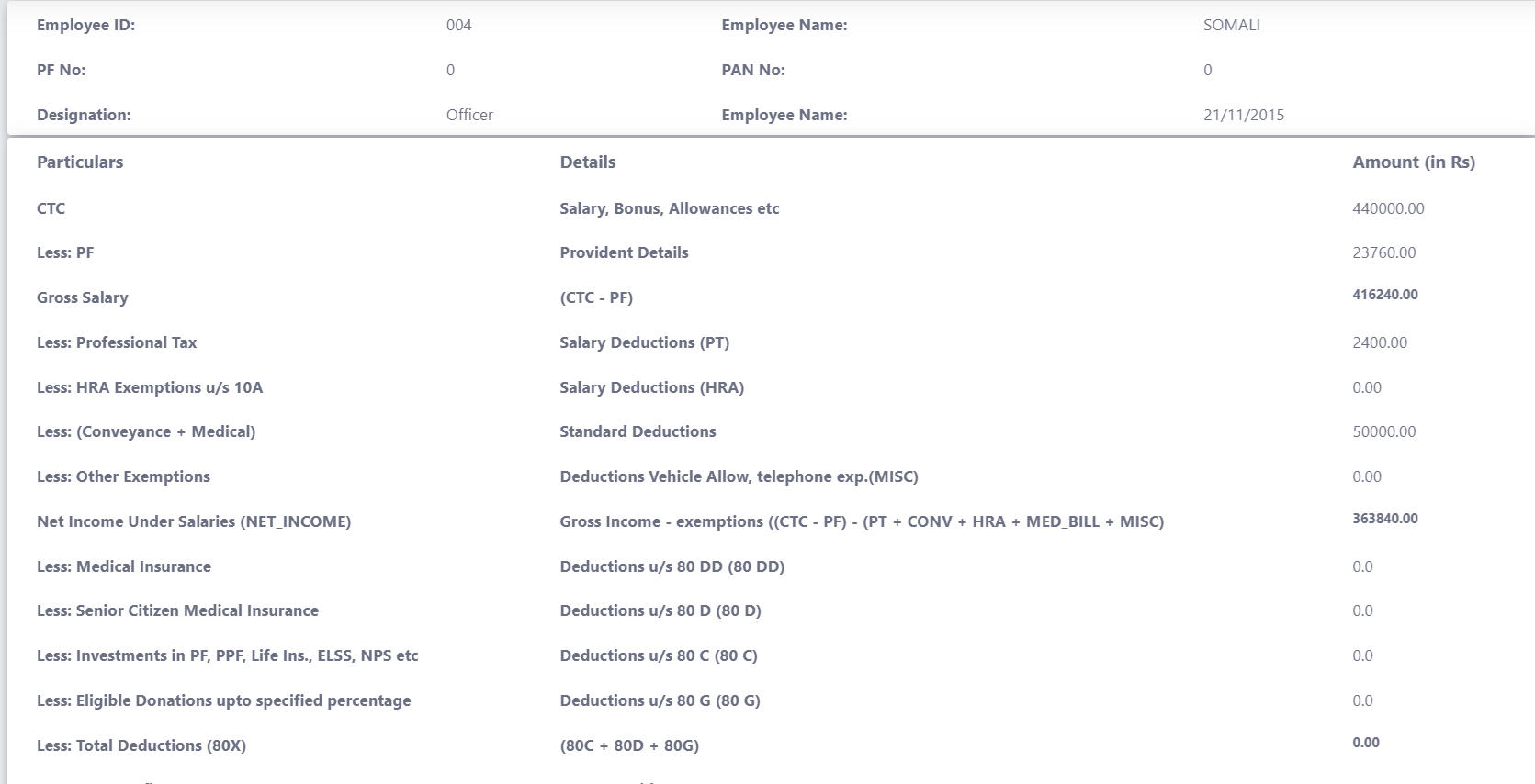

IT Computation:

Tax Calculation: The system allows for instant calculation of income tax (IT) based on salary structure, deductions, exemptions, and investment details.

Detailed IT Breakup: A detailed breakdown of the income tax computation is available at the click of a button, giving employees and HR visibility into the tax deductions for each payroll cycle.

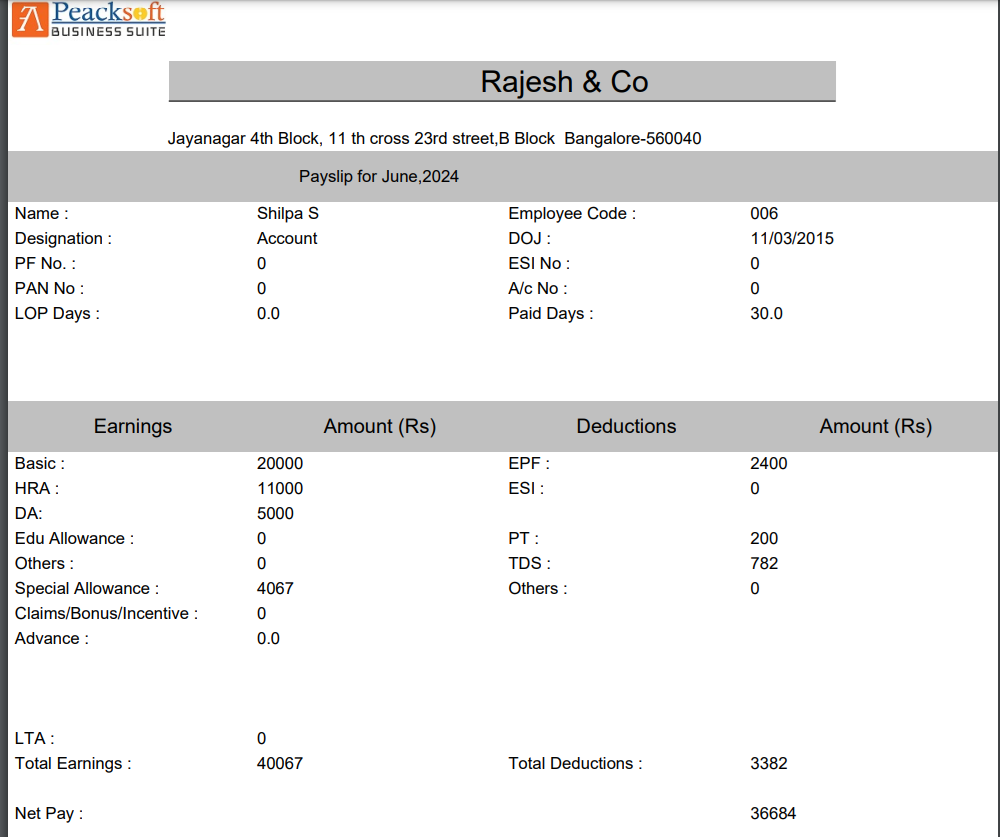

Payslip Generation:

Employee Payslip Access: Payslips can be generated easily for each employee. Employees can access their payslips via the Employee Self-Service (ESS) Portal, where they can download or view them.

Email Payslip Delivery: HR can also send payslips directly to employees' email addresses, ensuring timely and convenient delivery of payroll information.

Peacksoft Payroll simplifies payroll management with its ability to accommodate different salary structures, manage claims, handle tax computations, and facilitate easy payslip generation—all while ensuring compliance with statutory regulations.

Attendance & Leave Management

Attendance & Leave Management in Peacksoft HRMS offers a robust system for tracking employee attendance, managing leaves, and integrating biometric attendance data. Here's how it works:

Attendance Tracking:

Hourly Attendance Recording: Peacksoft HRMS records employee attendance on an hourly basis. This ensures precise tracking of work hours, including overtime, late arrivals, early departures, and absenteeism.

Overtime Calculation: The system calculates overtime based on the employee's daily working hours and company policies. It provides a comprehensive attendance report with regular hours and overtime hours for payroll processing and management review.

Leave Management:

Monthly Leave Recording: Peacksoft tracks and records various types of leaves for employees, including:

1. Loss of Pay (LOP): For unpaid leave when employees have exhausted their leave balance.

2. Earned Leave (EL): Accrued leave based on the employee’s tenure and service.

3. Casual Leave (CL): Leave granted for personal reasons, typically shorter durations.

4. Extraordinary Leave (XL): For situations requiring extended leave, like medical reasons or emergencies.

Leave Adjustment: The system adjusts leave balances automatically based on the employee’s leave applications, ensuring that accurate leave records are maintained.

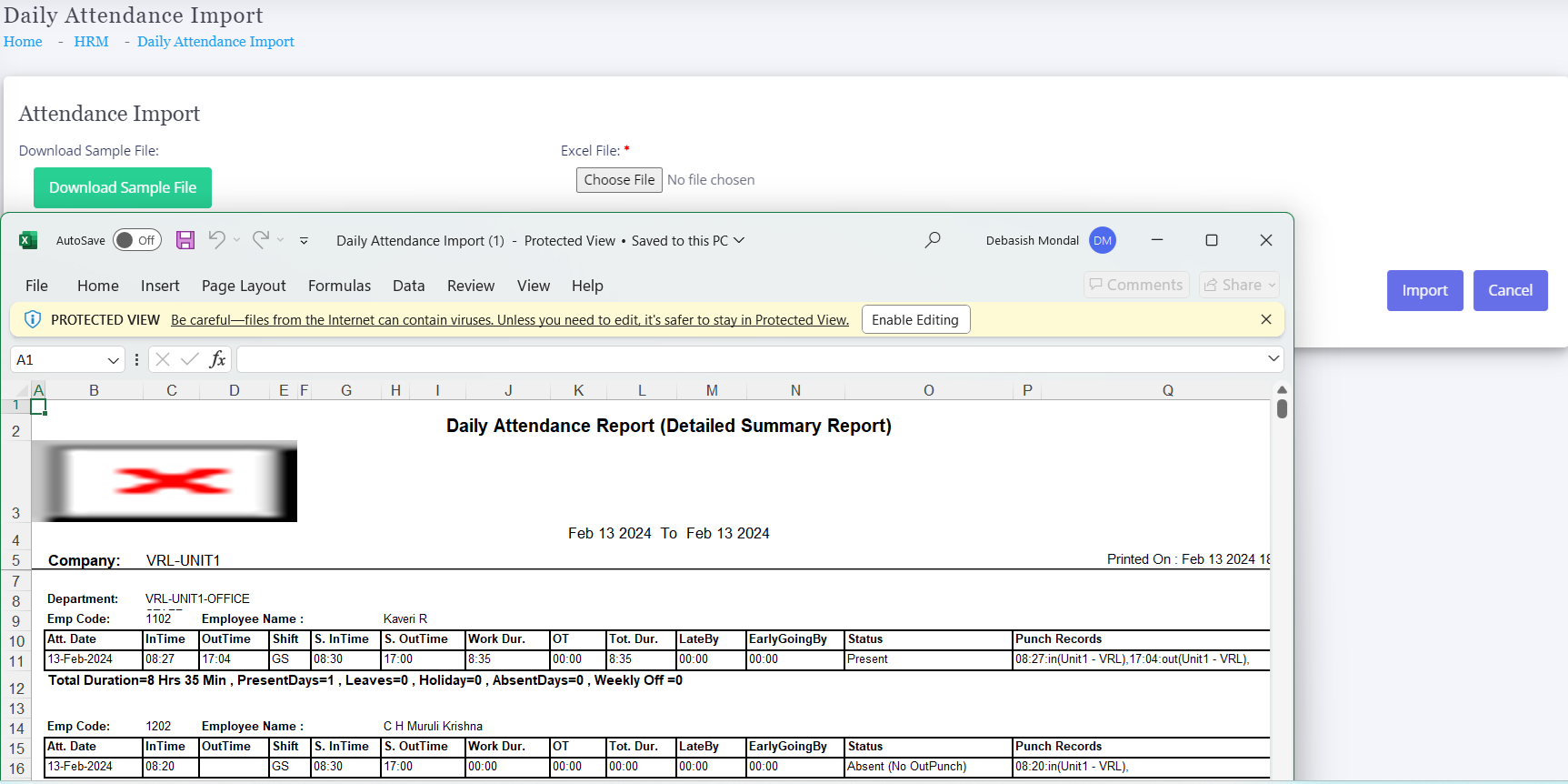

Biometric Attendance Integration:

Biometric Attendance Import: Peacksoft HRMS supports the import of biometric attendance data through CSV files exported from biometric devices. This allows for seamless integration of physical attendance tracking into the system.

Holiday & Leave Validation: Once the biometric data is imported, the system cross-references it with holidays, weekends, and employee leave records to accurately calculate the number of days worked in the month.

Leave Without Pay (LOP) Calculation: The system automatically calculates Loss of Pay for employees who have unapproved absences or exceed their leave balance after adjustments.

Peacksoft’s Attendance & Leave Management module simplifies tracking of work hours and leaves while providing accurate attendance reports and payroll data, ensuring compliance with company policies and statutory regulations.

Compliance

The HRMS Compliance Report in Peacksoft HRMS provides a comprehensive set of reports to ensure regulatory compliance related to employee payroll, taxes, and statutory contributions. These reports cover essential payroll and statutory components, allowing organizations to manage and report their obligations effectively. Here’s an overview of the key compliance reports:

1. TDS Payable Report:

TDS (Tax Deducted at Source) Payable: This report shows the TDS amount deducted from employees’ salaries that needs to be paid to the government. It provides details on individual employee contributions, total TDS payable, and the due dates for remittance.

2. Provident Fund Payable Report:

Provident Fund (PF) Payable: This report tracks the total PF contributions by both employees and employers that need to be deposited into the employee’s provident fund account. It includes:

Employee’s share of PF contributions.

Employer’s share of PF contributions.

Total payable PF amount for the given period.

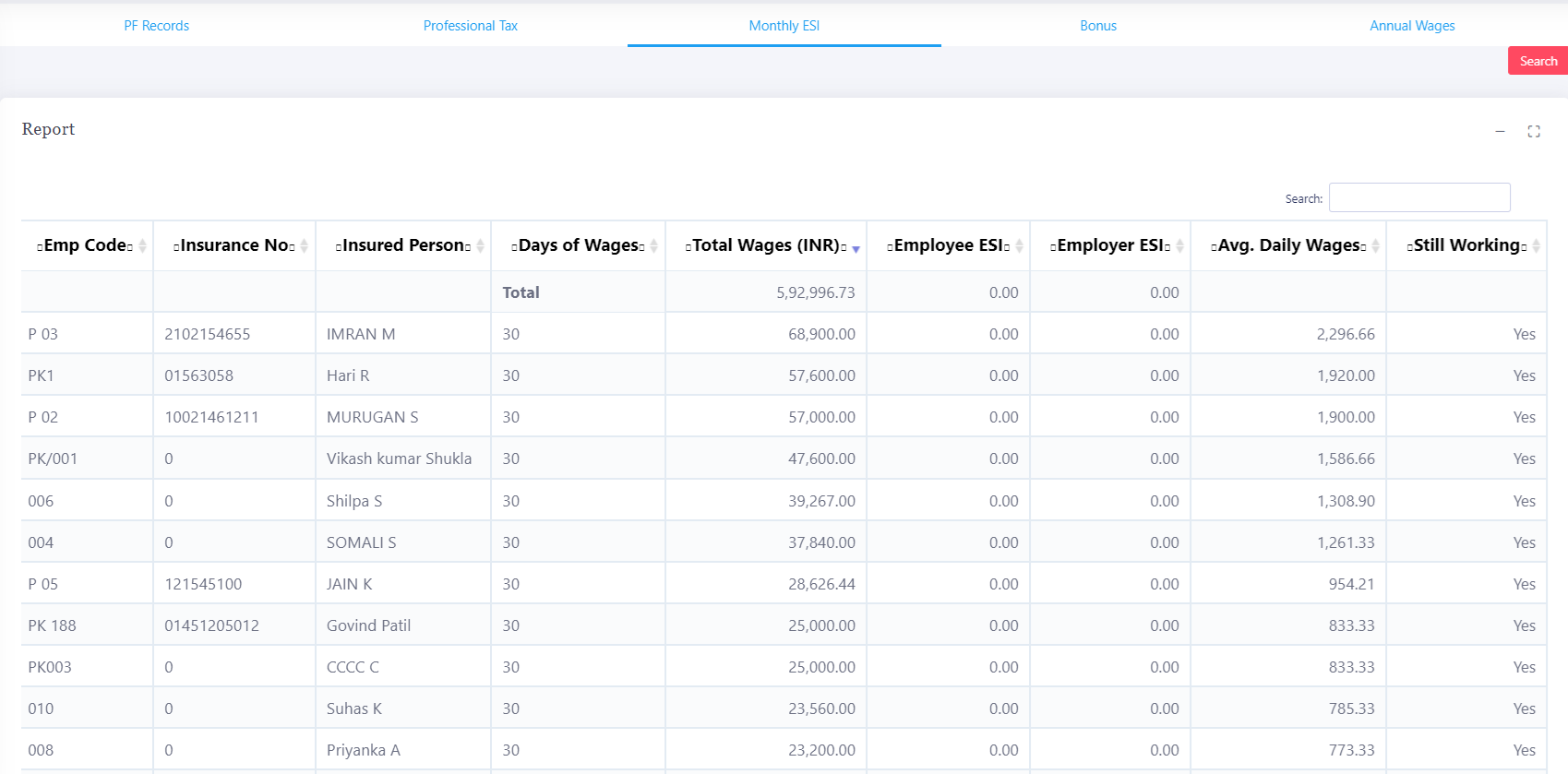

3. ESI Payable Report:

Employee State Insurance (ESI) Payable: The ESI Payable report calculates the amount due for employee insurance contributions. It includes:

Employee ESI contributions.

Employer ESI contributions.

Total ESI payable, along with the due dates for payment.

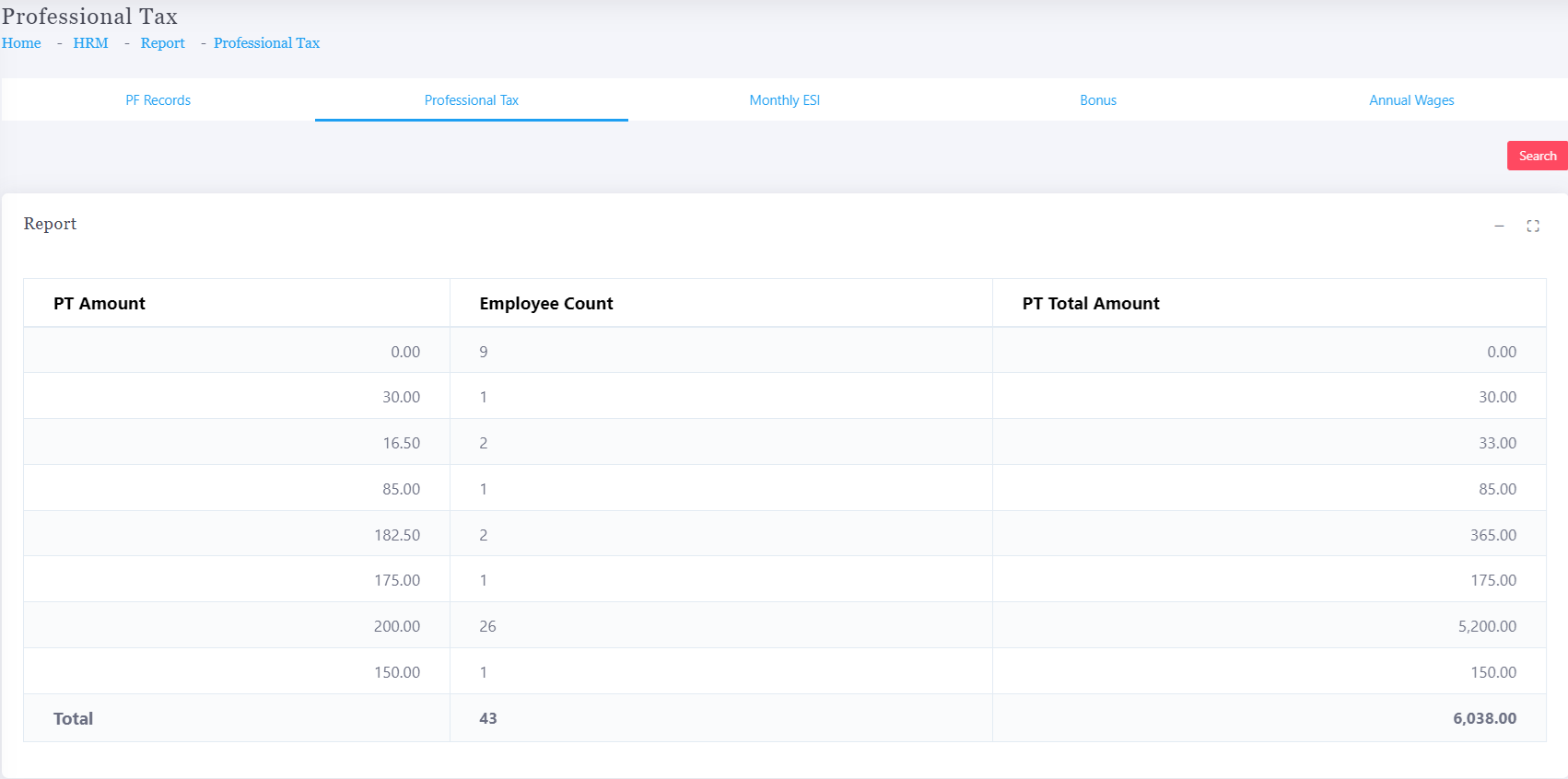

4. Professional Tax Payable Report:

Professional Tax (PT) Payable: This report outlines the professional tax deducted from employee salaries, based on applicable state laws. It tracks:

The total professional tax payable for all employees.

Individual employee contributions.

The remittance schedule for paying professional tax.

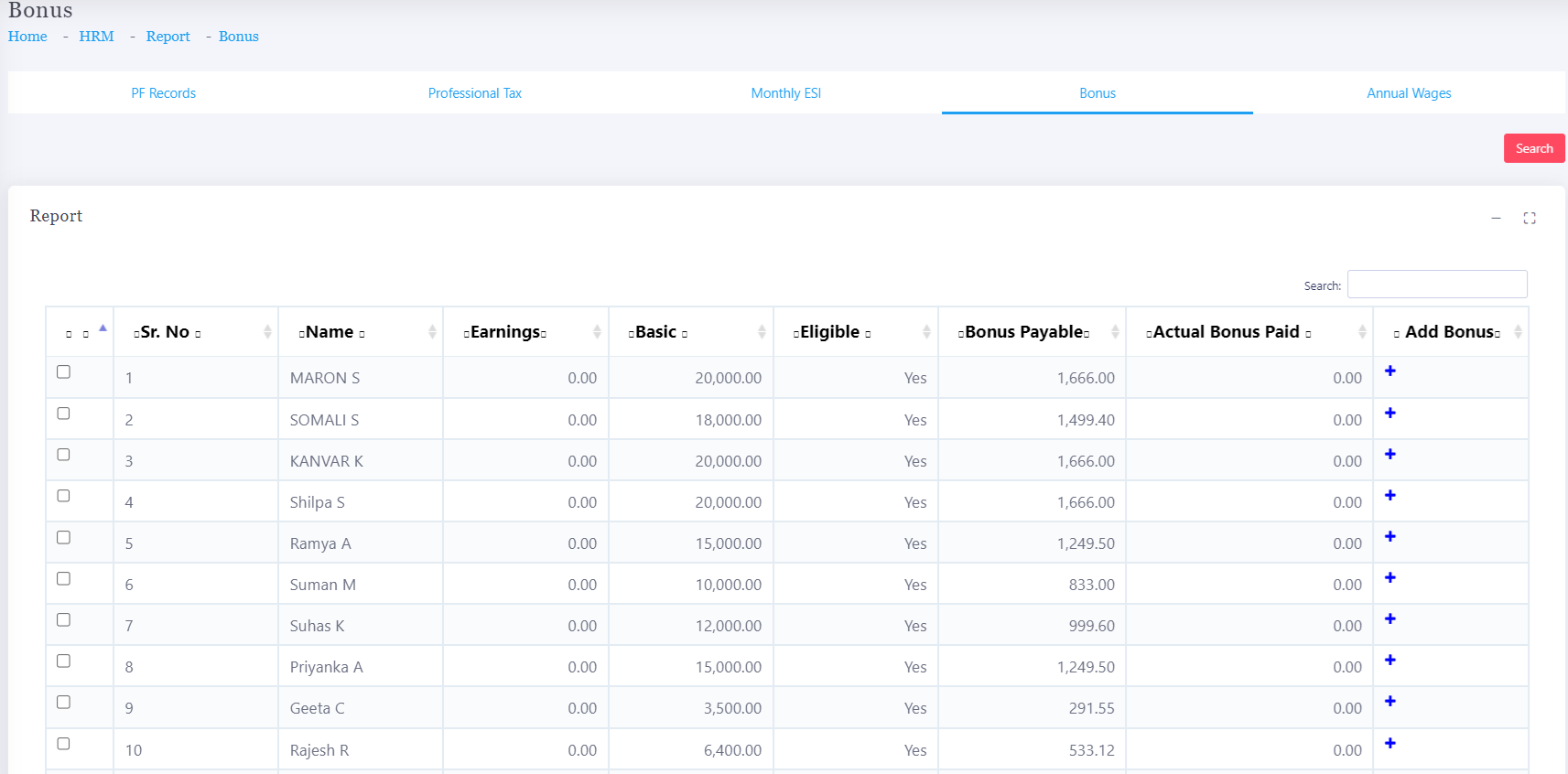

5. Bonus Report:

Bonus Report: The bonus report provides details of the bonus payments due to employees based on eligibility and company policies. It calculates the bonus amount for each employee, showing:

Employee-wise bonus payable.

Eligibility criteria (e.g., tenure, performance).

Total bonus payable to all employees.

6. TDS Salary Report:

TDS Salary: This report shows the total taxable salary after deductions (such as provident fund, ESI, etc.), on which TDS is calculated. It provides:

Gross salary.

Deductions under applicable sections (like 80C).

Net taxable salary and corresponding TDS amount.

7. Provident Fund Report:

Provident Fund: This report tracks the provident fund contributions made over time for each employee. It shows:

Employee contributions.

Employer contributions.

Cumulative provident fund balance.

These compliance reports help the HR and finance teams stay on top of statutory obligations, ensuring that all necessary payments are made on time and accurately recorded in accordance with legal requirements.

Performance Management System - PMS

The Performance Management System in Peacksoft HRMS facilitates a structured and transparent process for managing and evaluating employee performance. It aligns individual employee goals with broader company objectives, supports continuous feedback, and integrates a 360-degree review approach for comprehensive performance appraisals. Here’s an overview of the core features:

1. Company Goal Setting and Employee Goal Creation

Company Goal Setting: The system allows company leadership to define overarching business goals, which serve as the foundation for individual and departmental targets.

Employee Goal Creation: Managers can create specific, measurable goals for each employee, aligned with the company’s strategic objectives. Employees can view and understand how their contributions support broader company success. This goal-setting process ensures that:

Employee goals are tied to business objectives.

Employees and managers have a clear understanding of expectations.

2. Periodic Goal Reviews

Employee Self-Reviews: Employees can regularly update their progress against the set goals, providing self-assessments of their achievements, challenges, and areas for improvement.

Manager Reviews: Managers conduct periodic reviews of employee goals, providing feedback on progress, offering guidance for improvement, and adjusting targets if necessary. This allows for continuous alignment between employee efforts and business needs.

Collaborative Goal Adjustment: Based on performance reviews, goals can be adjusted by managers in consultation with employees, ensuring they remain relevant and achievable throughout the year.

3. Performance Appraisal Process

End-of-Year Appraisal: At the end of the performance cycle (typically annually), the formal performance appraisal process is initiated. The system aggregates the data collected throughout the year, including:

Periodic reviews.

Goal progress updates.

Feedback from managers.

360-Degree Review: A 360-degree review is initiated as part of the appraisal, where feedback is requested from:

Peers: Colleagues who work closely with the employee provide insights into their collaboration, teamwork, and interpersonal skills.

Managers: Direct supervisors assess goal achievement, leadership, and overall performance.

Subordinates (if applicable): For managerial roles, feedback is gathered from subordinates on leadership effectiveness.

Self-Review: Employees also complete a self-assessment as part of the 360-degree review, reflecting on their accomplishments and areas for growth.

4. 360-Degree Review Feedback

Multi-Perspective Feedback: The system consolidates reviews from peers, managers, and subordinates to provide a comprehensive view of an employee’s performance. Key areas assessed include:

Goal and Key Result Area (KRA) achievements.

Behavioral competencies like communication, leadership, teamwork, and problem-solving.

Adherence to company values and cultural fit.

5. Final Appraisal and Performance Measurement

Manager's Evaluation: The manager considers both the periodic reviews and 360-degree feedback to deliver a final performance rating or evaluation. This holistic approach ensures a well-rounded assessment of the employee’s contributions.

Performance Ratings: Based on the final appraisal, employees are assigned performance ratings or grades, which can impact salary increments, promotions, or performance improvement plans.

This Performance Management System promotes a culture of continuous improvement, encourages regular feedback, and ensures fairness in employee evaluations by incorporating multiple viewpoints through the 360-degree review process.

Training Management System - TMS

The Training Management System in Peacksoft HRMS supports both company-driven training initiatives and employee-specific training goals, ensuring effective skill development and capacity building within the organization. The key features of this system are outlined below:

1. Company Training Goals

Yearly Training Plan: The company sets annual training objectives aligned with business needs. These training goals focus on improving employee competencies and ensuring workforce readiness for current and future demands. The training programs may be targeted at specific departments or roles based on skill gaps or new initiatives.

2. Employee Training Goals

Employee-Driven Training Requests: Employees can set personal development goals by requesting training that aligns with their roles, career aspirations, or specific skill gaps. These goals may stem from performance reviews or individual career planning discussions with managers.

3. Training Schedule

Training Sessions: The company organizes training sessions based on its annual goals, creating detailed schedules with predefined seats and resources.

Trainers: The company can assign internal trainers or hire external experts to conduct training programs, ensuring the quality and relevance of the training.

Calendar Integration: Training schedules are published on the company calendar, providing visibility to employees and allowing them to plan their participation accordingly.

4. Employee Training Requests

Training Request System: Employees can submit requests for specific training programs listed in the training calendar. These requests are reviewed by managers or HR administrators for approval.

Training Relevance: Employees may submit requests based on personal or role-specific training needs, aligning their skills with company objectives or preparing for career progression.

5. Employee Enrollment

Enrollment Process: Managers or HR admins manage the enrollment of employees into training programs, based on seat availability and the suitability of the employee for the training.

Cancellation Policy: Employees or managers can cancel an enrollment with a valid reason, allowing the slot to be filled by other participants.

6. Employee Training Attendance and Assessment

Attendance Recording: During the training session, employee attendance is tracked, ensuring that participants are actively engaged in the learning process.

Training Participation Notes: Managers or trainers can add participation notes, providing insights into how each employee engaged with the training content.

Assessment: After the training, employees are evaluated through assessments to measure the effectiveness of the program. The assessment results help gauge how well the training objectives were met and whether the employee's skills have improved.

7. Training Survey

Feedback Collection: A training survey is distributed to both the trainers and the employees to gather feedback on various aspects of the training program, such as content relevance, trainer effectiveness, and overall experience.

Assessment of Training Effectiveness: Feedback from the survey is analyzed to determine the effectiveness of the training. Insights from these surveys can help improve future training programs and ensure they meet the desired outcomes.

This Training Management System ensures that both employee-driven and company-led training programs are efficiently managed, helping employees develop their skills while contributing to organizational goals. The process from scheduling to feedback is structured to ensure continuous improvement in training effectiveness and employee development.

Get Started with Peacksoft ERP Today

Intuitive solutions on cloud with integrated features like Accounting, Purchase, Sales, Production, CRM, Payroll, Inventory & Filing of all compliances. . Call us at +91-86608 58802 (M: 9845167247) to schedule a consultation.